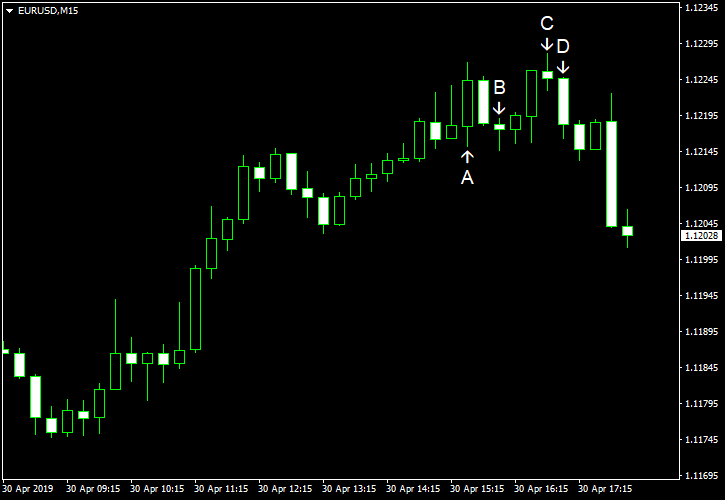

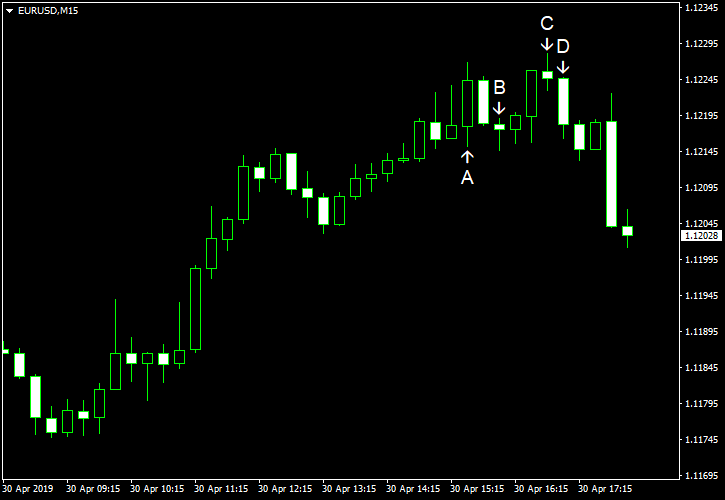

EUR/USD rallied today, rising for the third consecutive trading session. Markets welcomed macroeconomic data released in the eurozone today, even though not all indicators were good. US economic data was mixed as well.

S&P/Case-Shiller home price index rose 3.0% in February on an annual basis. That is compared to the forecast increase of 3.7% and the January growth by 3.5%. On a monthly basis, the index rose 0.2%. (Event A on the chart.)

Chicago PMI dropped to 52.6 in April from 58.7 in March, reaching the lowest level since January 2017. That was a total surprise to experts who were expecting an increase to 59.1. (Event B on the chart.)

Consumer confidence climbed to 129.2 in April from 124.2 in March, far above the forecast figure of 126.2. (Event C on the chart.)

Pending home sales edged up 3.8% in March after falling 1.0% in February. That is compared to the forecast increase of 1.1%. (Event D on the chart.)

Yesterday, a report on personal income and spending was released, showing an increase of 0.1% for income and 0.9% for spending in March after demonstrating a 0.2% increase for income and a 0.1% increase for spedning in the previous month. That is compared to the median forecast of an increase by 0.4% for income and 0.7% for spending. Core PCE inflation was at 0.0%, whereas analysts had predicted the same 0.1% as in the previous month. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.