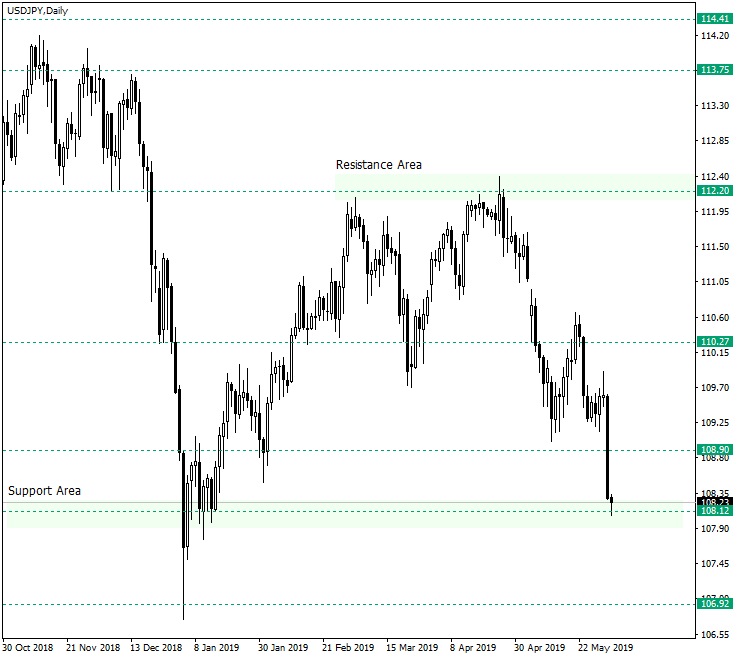

The descent on the US dollar versus the Japanese yen reached the important target of 108.12, a level that represents a weekly support area. But certain factors point to the fact that, this time, the support might would not hold its ground.

Long-term perspective

After the confirmation of the 112.20 resistance area, on April 25, 2019, the price began a steep decent, that stopped at 108.90, throwed-back to confirm 110.27 as resistance, and continued downwards to pierce 108.90 and then reach 108.12. So, just by taking in account this behavior, the price is expected to pullback to 108.80, conform it as a resistance, and resume the drop.

Another way of assessing the situation is that, since the confirmation of 112.20, the price printed lower-highs and lower-lows. To this adds the piercing of 108.90, a level that has been respected for quite a while. Put together, a strong bearish signature can be seen in the evolution of the currency pair.

So, as long as the price is not reconquering 108.90, the bears are in control and 106.92 is only a matter of time. In spite of any bullish efforts, as long as the price is under 108.90, any appreciation is a new chance for the bears to short from a better price.

Shot-term perspective

The level of 109.12 served as a support since the middle of April 2019, but it eventually got pierced and allowed a very convinced bearish move.

In the very short term, the price could retrace to find resistances that would serve a new descent. Of course, a consolidation pattern — such as a pennant, rectangle or flag — could also emerge and, in the end, play out its role as a continuation pattern, marching towards 107.56.

Levels to keep an eye on:

D1: 108.12 106.92 108.90

H4: 108.01 108.90 107.56 108.77 109.12

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.