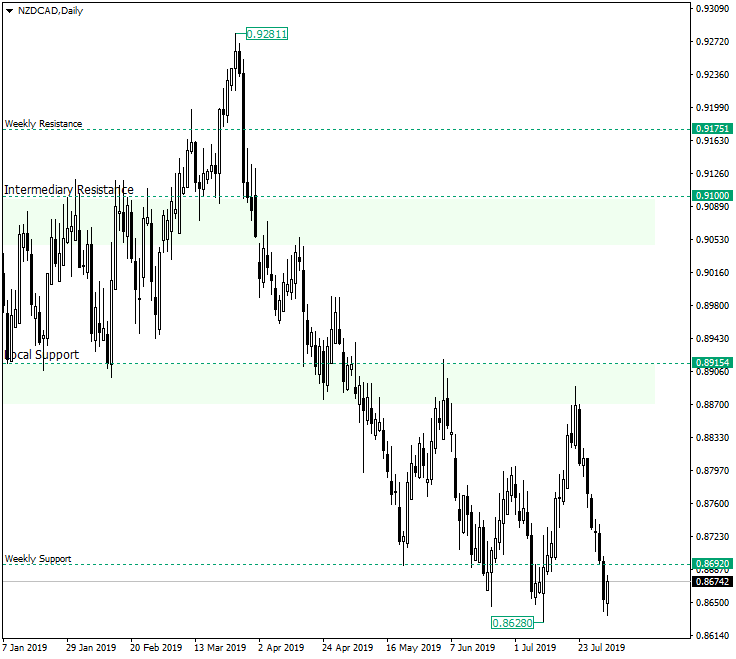

The New Zealand dollar versus the Canadian dollar currency pair is in a spot from where it could go either way for a considerable amount of time and pips.

Long-term perspective

After falsely piercing 0.8692, the low of 0.8628 favored the bulls who managed to bring the price very close to the local support level of 0.8915. The next step would have been a consolidation and the continuation of the ascending move, as the bulls had the situation in their favor.

But on July 23, 2019, a bearish engulfing was etched and caused a descent that not only postponed the possibility of a movement to the north in the very near future, but also opened the door to the bears, who took the chance and drove the price under the important weekly level of 0.8692.

For the time being the current low is a higher low, if compared to the previous one at 0.8628. This could favor a bullish comeback, with the bulls trying to render — yet again — the piercing as a false one by dragging the price above 0.8692 for a third time this year.

So, if any bullish price action occurs and the price confirms 0.8692 as support, then a revisit of 0.8915 — and maybe even a valid piercing of it — is possible. However, the very strong decline that followed the bearish engulfing and the fact that it absorbed almost entirely the rally from 0.8628 makes the buyers be very reluctant at pushing the market any higher. In this case, the first target is represented by 0.8577 and followed by 0.8500.

Short-term perspective

The decline that confirmed 0.8900 area as resistance is healthy and looking determined to push the prices even lower.

As long as the price fails to find support levels after each small rally, the expectancies are for the downwards movement to continue. A fist target is represented by the psychological level 0.8600.

Only the installment of the price above 0.8716 will postpone or cancel further declines.

Levels to keep an eye on:

D1: 0.8692 0.8577

H4: 0.8667 0.8600 0.8716

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.