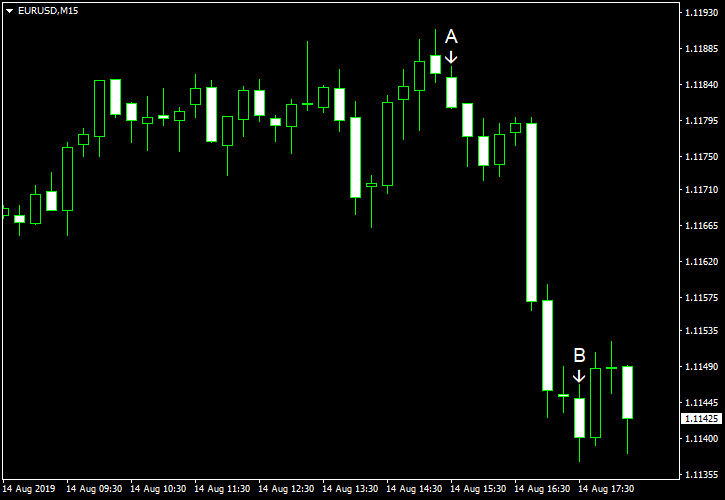

EUR/USD declined for the second day today after Washington announced yesterday that it will delay implementation on new tariffs on Chinese goods till December. It will be done to relieve pressure on consumers during the Christmas season. US macroeconomic data was decent enough to provide an additional boost to the dollar.

Both import and export prices rose 0.2% in July after falling in June. Analysts did not expect any change to import prices. Import prices fell 1.1% (revised) and export prices declined 0.6% in June. (Event A on the chart.)

US crude oil inventories increased by 1.6 million barrels last week instead of falling by 2.5 million barrels as analysts had predicted. The stockpiles expanded by 2.4 million barrels the week before. Total motor gasoline inventories decreased by 1.4 million barrels. (Event B on the chart.)

Yesterday, a report on CPI was released, showing an increase of 0.3% in July, which was in line with expectations. The index rose 0.1% in June. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.