- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: October 2, 2019

October 2

October 22019

Last Call for the Bulls on USD/JPY from 106.92

The US dollar versus the Japanese yen currency pair dropped after a very nice rally, putting in danger the possibility of further appreciation. Long-term perspective After the apparent false break that printed the high of 108.47, the price rallied from 106.92 to the now double resistance materialized by the lower line of the angled rectangle and the 108.12 level, the confirmation of which occurred. After this confirmation, the price made a drop that brought the price — at the time of writing — […]

Read more October 2

October 22019

Japanese Yen Rebounds Amid Sales Tax Hike, Renewed Safe-Haven Status

The Japanese yen is rallying against most major currency rivals midweek as the worldâs third-largest economy implemented a long-awaited sales tax hike. This comes as Wall Street is forecasting the yen will enjoy a monumental rally to finish off the year amid the chaos unfolding in global markets. Are investors dismissing the weak data this week? On Tuesday, Tokyo raised the national sales tax from 8% to 10%, the first hike […]

Read more October 2

October 22019

Pound Falls on Weak UK Construction PMI, Rallies on New Brexit Proposals

The British pound today recovered from its daily lows and rallied higher in the late London session as details emerged of a new Brexit proposal by the British government. The European Union’s positive response to the proposals boosted investor confidence in the pound, causing it to rally higher despite the weak UK PMI released earlier today. The GBP/USD currency pair today fell to a low of 1.2228 in the early London session before recovering and rallying to a daily high […]

Read more October 2

October 22019

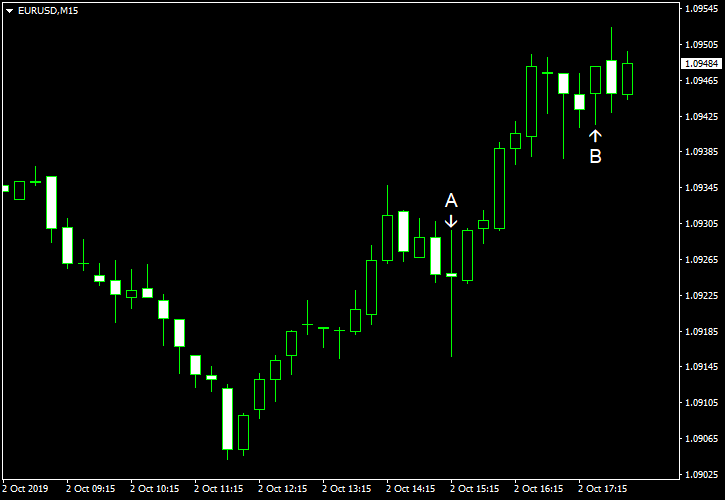

EUR/USD Rebounds Despite Employment Growth Matching Expectations

EUR/USD was falling earlier today but has bounced by now, rising above the opening level. The bounce happened despite decent US employment data that matched expectations. ADP employment rose by 135k in September, close the to the median forecast of 140k but less than in August — 157k (the reading which itself got a negative revision from 195k). (Event A on the chart.) US crude oil inventories climbed by 3.1 million last […]

Read more