- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: November 1, 2019

November 1

November 12019

Pound Whipsaws on UK and US Releases as General Election Looms

The Sterling pound today traded sideways against the US dollar as UK political parties started campaigning in readiness for the UK December 12 elections. The GBP/USD currency pair had a muted reaction to the upbeat Markit/CIPS UK manufacturing PMI data but fell on the robust US non-farm payrolls report before rallying higher after later US releases. The GBP/USD currency pair today traded within a tight range marked by a high of 1.2972 […]

Read more November 1

November 12019

US Dollar Rises on Stronger-Than-Expected October Jobs Report

The US dollar is rising to close out the trading week, thanks to a stronger-than-expected October jobs report. The positive labor report comes shortly after the latest economic data showed that it is slowing down less than what the market anticipates. But manufacturing continues to impact the worldâs largest economy and its monthly jobs numbers. According to the Bureau of Labor Statistics (BLS), the US economy added 128,000 new jobs […]

Read more November 1

November 12019

Bears Try a Comeback from 0.6900 on AUD/USD

The Australian dollar versus the US dollar currency pair recovered but seems to have trouble passing the 0.6900 handle. Long-term perspective After confirming the support of the 0.6700 psychological level, the price entered in an appreciation phase that took out two important resistance areas, 0.6800 and 0.6858, respectively. The breach of 0.6858 allowed the price to reach the 0.6925 high, thus piercing 0.6900 which an area that the bears are protecting — at least they […]

Read more November 1

November 12019

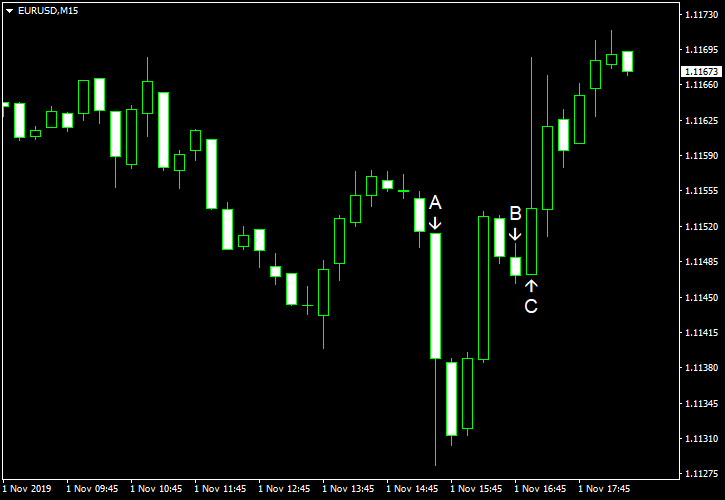

EUR/USD Dips After US NFP, Bounces Later

EUR/USD declined following the release of US nonfarm payrolls as employment growth beat expectations. But the currency pair rebounded later as markets turned their attention to wage inflation that missed expectations. US nonfarm payrolls rose by 128k in October, beating the average forecast of 90k. The September increase got a big positive revision from 136k to 180k. Unemployment rate rose a bit from 3.5% to 3.6%, but market participants were […]

Read more