- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 3, 2020

January 3

January 32020

US Dollar Sideways as Key Manufacturing Index Slumps to 10-Year Low

The US dollar is trading sideways at the end of the trading week as the manufacturing sector continues to slump at a decade-low. Can the manufacturing industry turn things around in 2020 as the US and China gradually wind down their 18-month trade dispute? From trade certainty to the White Houseâs aim for a weak dollar policy, American manufacturers may have a rebound year. The Institute for Supply Management (ISM)âs manufacturing index fell to 47.2 in December, down from […]

Read more January 3

January 32020

Euro Falls on Risk-Off Mood, Ignores German CPI Data, Later Recovers

The euro today fell against the US dollar driven by the risk-off sentiment that ensued after the US killed a top Iranian general earlier today spooking investors. The EUR/USD currency pair ignored the release of upbeat German inflation data but later recovered as the greenback lost momentum in the American session. The EUR/USD currency pair today fell from an opening high of 1.1178 in the Asian session to a low of 1.1125 in the mid-European session but had […]

Read more January 3

January 32020

Pound Falls Against the Dollar on US-Iran Tensions and Weak UK PMI

The Sterling pound today fell against the US dollar as tensions between the US and Iran escalated overnight and investors dumped riskier assets such as the pound. The GBP/USD currency pair has given up most of the gains made in December following Boris Johnson‘s landslide election win that saw the pair spike to multi-month highs. The GBP/USD currency pair today fell from an opening high of 1.3159 in the Asian session to a low of 1.3067 in the mid-London […]

Read more January 3

January 32020

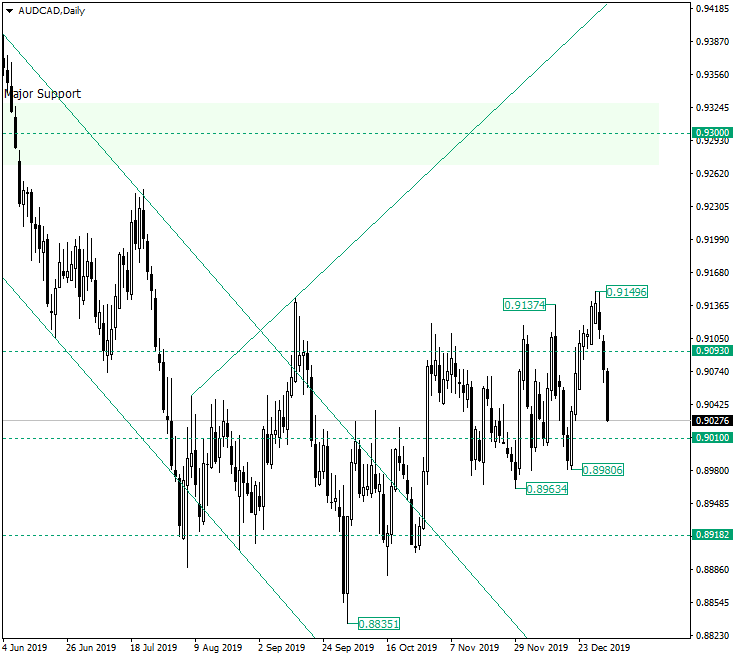

AUD/CAD Could Revisit the 0.9010 Area

The Australian dollar versus the Canadian dollar currency pair turned around from its initial path towards the 0.9300 level. Are the bulls only recharging or did they allow a bearish victory? Long-term perspective After printing the low of 0.8835, the price appreciated and exited from the descending channel, but it was limited by the resistance of 0.9093. The bullish attempts were put on hold every time, but the resulting depreciations were finding […]

Read more