The US dollar versus the Japanese yen currency pair seems to be willing to continue the decline. Do the bulls still have any options left?

Long-term perspective

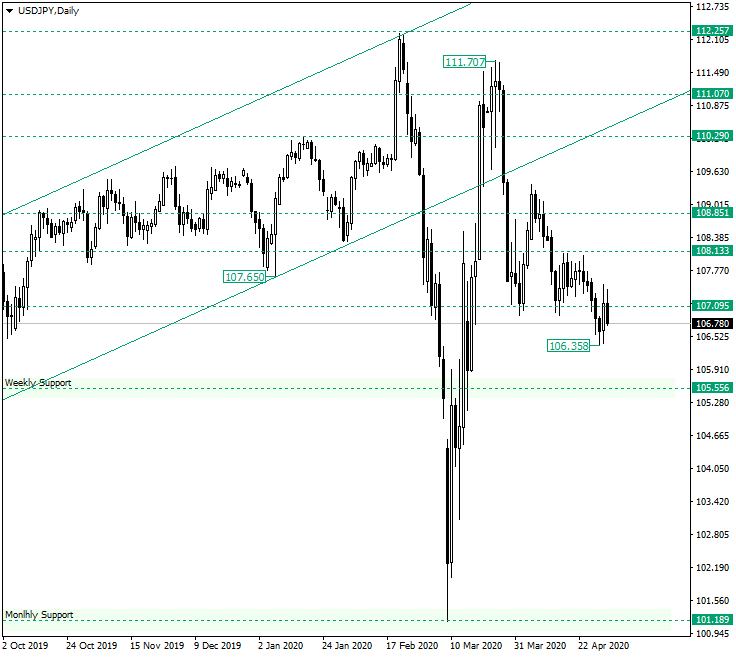

The decline that started from the high of 111.70 found support at 107.05, which is the technical correspondent of the 107.00 psychological level. From there, an appreciation commenced, but it did not manage to conquer the 108.85 level, thus, confirming it as a resistance. This lead to a new decline that stopped, yet again, at the 107.05 level. What followed was only a small try from the bullish side. This lack of conviction aided to the confirmation of 108.13 as resistance, which in turn facilitated the bears.

As a result, the bears pierced the 107.05 level and printed the low of 106.35. If 107.05 is confirmed as resistance, then the bears could set 105.55 as their next target. Noteworthy is that the low of 106.35 may be an area from where the bulls might try to turn the situation in their favor, but after it is taken out, that would not be an option anymore.

If the bulls manage to bring the price above 107.05, their first target would be 108.13. This level may be guarded by the bears, so unless the bulls don’t conquer it, the level could spark a new depreciation, targeting 107.05 first, followed by 105.55.

Short-term perspective

The price confirmed the double resistance made possible by the descending trendline that starts from 109.06 and the 107.38 level.

As long as the price sits under the trendline, the bears are in hold of the situation. So, even if an appreciation does occur, it may very well confirm 107.06 as resistance. Even if the price passes this level, 107.38 is the next barrier in front of the bullish movement.

Of course, a false piercing of the aforementioned double resistance could also put in motion a decline. The first target for any of the abovementioned bearish scenarios is represented by 106.41, while the second is 105.68. On the other hand, the current depreciation may simply continue, targeting these tow levels.

Only if the price confirms 107.38 as support, and, of course, brakes the trendline, then it can be considered that the bulls have a shot until 107.92 which, if pierced, may allow them to extend until 108.43.

Levels to keep an eye on:

D1: 107.05 105.55 108.13

H4: 107.06 107.38 106.41 105.68 107.92 108.43

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.