If you remember my June post about the

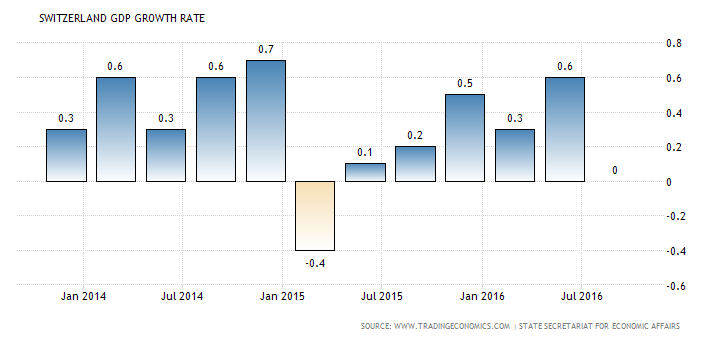

The main reasoning (except for the

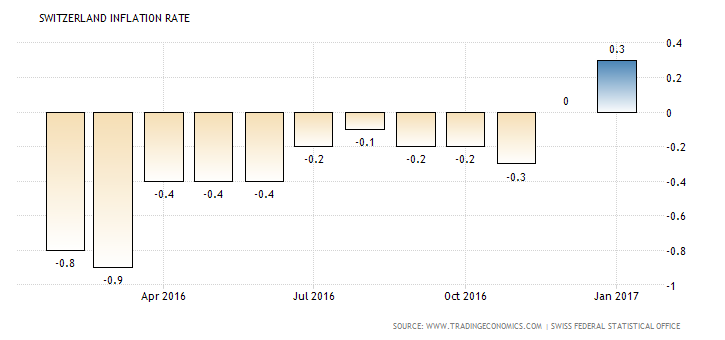

The CPI inflation rate is also returning to the normal values:

At the same time, the country’s foreign exchange reserves continue growing, signaling about an active intervention policy conducted by the Swiss National Bank to keep CHF from appreciating:

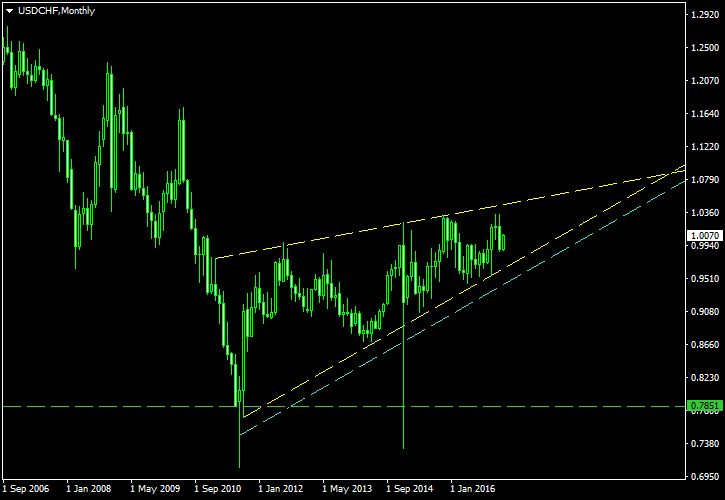

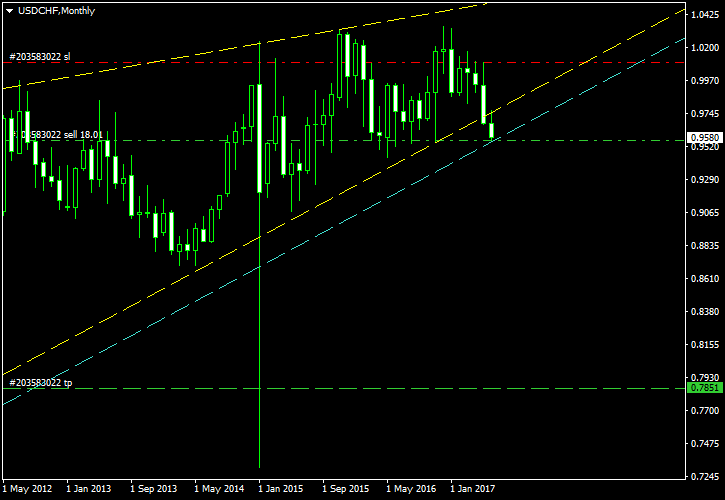

From the technical analysis point of view, the monthly chart is currently showing a rising wedge spanning from the early 2011. It was violated only twice — with huge downward spikes caused by the SNB’s manipulation. The entry can placed at a safe buffer distance below the lower border. The one on the chart (the cyan line) uses the 10% of the wedge’s height at the base as the buffer distance. The

One of the major problems with this trade is the unfriendly swap. However, the trade will only open after a breakout — when the bearish trend becomes prevalent. Hopefully, my

I will keep this post updated regarding this trade’s progress.

Update 2017-07-01: Actually, my pending order entry has triggered on June 29 at 0.9560 with

If you have any questions or comments about this