Are Forex charts random? Does trying to predict the market and trade currencies for profit even makes sense? Traders and curious people ask these questions and, I am sure, find a lot of contradicting answers online. The number of traders who claim getting consistent profits from the foreign exchange market is counterbalanced by a number of persons stating that the market cannot be predicted because

One of the most famous supporting work for the randomness theory is Eugene Fama‘s article Random Walks In Stock Market Prices. Despite it seeming contradiction, the market randomness theory is based on the

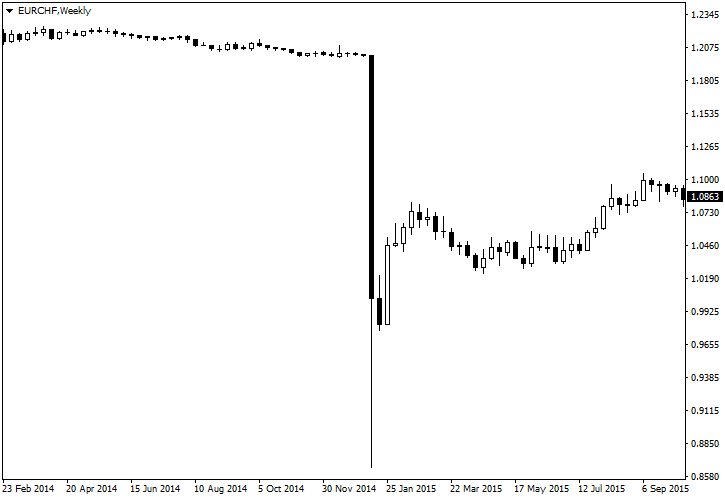

I will not be trying to prove one point or another here. I will just leave the following two chart images before the poll.

The first one is the

The second chart is a randomly generated one:

![]() Loading …

Loading …

If you want to share a detailed opinion on whether Forex market is random or not, please do so using the commentary form below.