Canadian dollar is in a

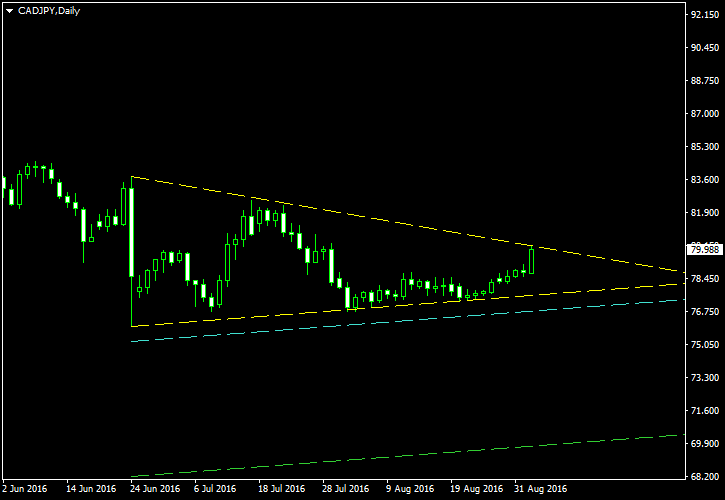

The symmetrical triangle is marked with the yellow lines on the screenshot below. As you can see, it is quite smooth, albeit not ideally symmetrical. The trade’s entry level can be placed at the cyan line — the 10% buffer for a breakout. The green line can serve as a selling target — it is placed at 100% of the triangle’s width at the base from the lower border. I will set my

I have built this chart using the ChannelPattern script. You can download my MetaTrader 4 chart template for this CAD/JPY pattern. You can trade it using my free Chart Pattern Helper EA.

Update 2016-09-16 12:20 GMT: CAD/JPY has finally triggered my short entry at 77.086 today at 10:57 GMT. With

Update 2016-10-05 16:39 GMT: The trade has hit its

If you have any questions or comments regarding this symmetrical triangle on CAD/JPY chart, please feel free to submit them via the form below.