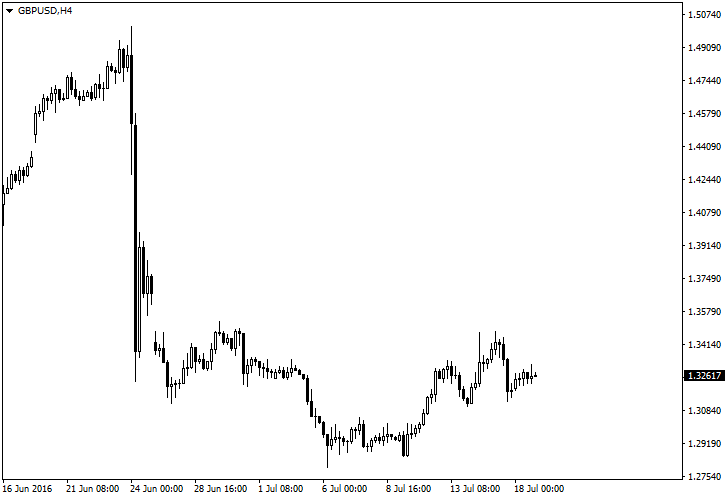

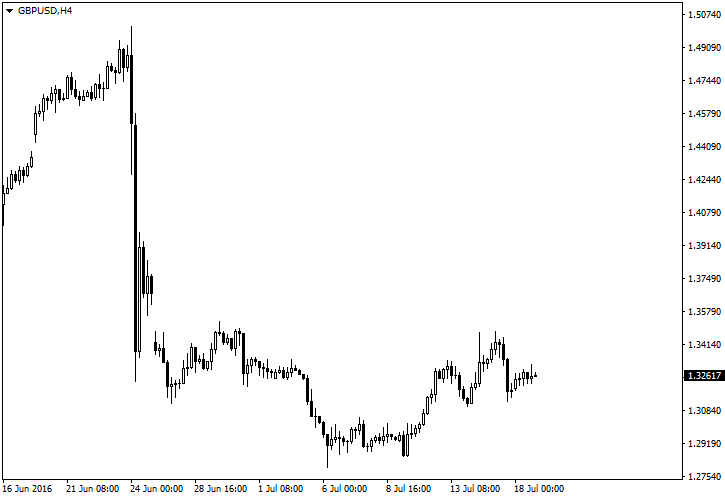

We have not written much about the Brexit because there already was a ton of analysis written by many respectable sources. And it all turned wrong on June 24 of course. Nevertheless, the unexpected outcome of the referendum offered a huge earning opportunity to FX traders. Even with brokers cutting leverage on GBP/USD and related pairs, the profit potential was enormous:

After all, the moves of 2,000 pips in just a few hours are quite rare in major currency pairs. Of course, it also meant losses for a large number of market participants. Although there is still much to be decided and traded before the matter could be considered settled, the main volatility in the foreign exchange market seems to be over now. It is time to look at the bottom line left after the great currency battle inspired by this political adventure.

My own results are not very impressive — I have chosen to stay on the sidelines, remembering the negative experience of many retail currency traders during January 15, 2015, Swiss franc havoc. Of course, I regret it now, but I do believe that there will be more opportunities based on the

![]() Loading …

Loading …

There is still a number of ways out of the mess the UK put itself in, and this provides two opportunities for smart Forex traders:

If you want to tell us more about how you managed to earn or to lose on Brexit, please do so using the commentary form below.