We have finally launched a

https://www.optionsreasy.com/EarnForex/

Right now it is only available in English, but translations to other languages will soon follow (if there is demand, of course).

Contents

-

1 Platform’s pros and cons

- 1.1 Advantages

- 1.2 Disadvantages

- 2 Interface

- 3 Trading instruments

-

4 How to trade?

-

4.1 Examples

- 4.1.1 Bullish trade on EUR/USD (New-to-options mode)

- 4.1.2 Bearish trade on GPB/JPY (Basic mode)

- 4.1.3 Straddle strategy in XAU/USD (Advanced mode)

- 4.2 How to close a position?

-

- 5 Account statements

- 6 Going live?

- 7 Strategies marketplace

Platform’s pros and cons

Before proceeding to detailed description of the platform’s trading interface and features, I would like to point out its main advantages and disadvantages.

Advantages

Disadvantages

Interface

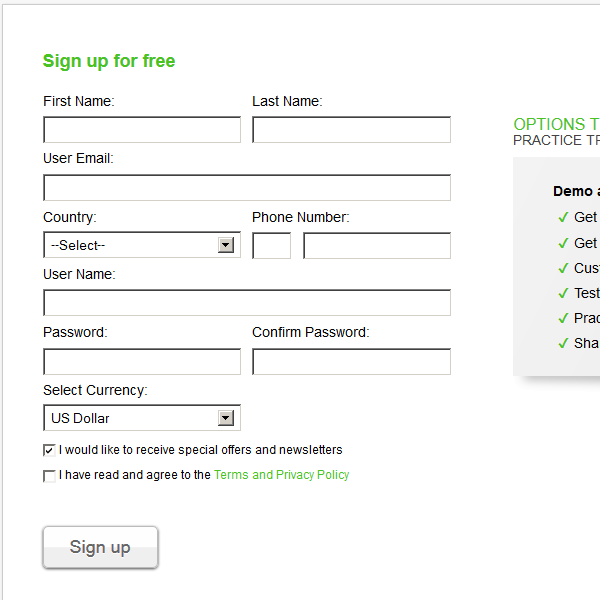

https://www.optionsreasy.com/EarnForex/

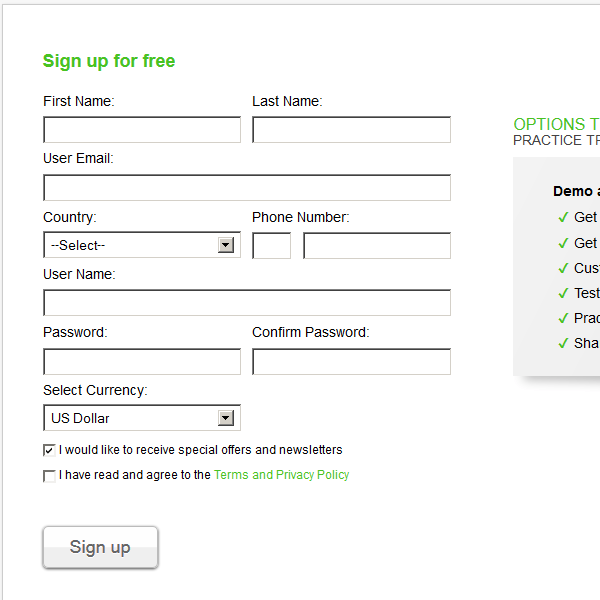

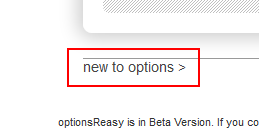

Once your account is created, you will be greeted with a welcome message asking about your level of expertise in options trading:

Once you choose your level, the demo options account will be available for trading immediately. Here is how the trading screen looks like in

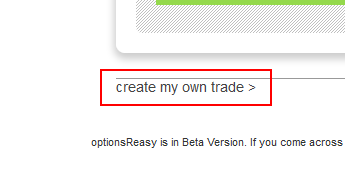

You can switch to custom trade (Basic mode) via the link under the first position selection:

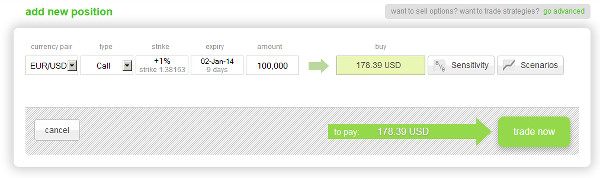

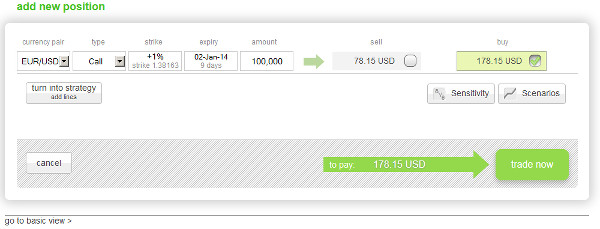

The custom trade screen offers some crucial position configuration parameters:

Switching back to

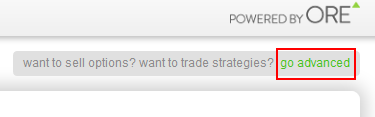

You can switch to Advanced trading mode at any time by clicking the respective link above the custom trade:

It will look like this:

Advanced mode allows selling the options. Uncovered sale is still not allowed, but you can use covered options sale to your advantage:

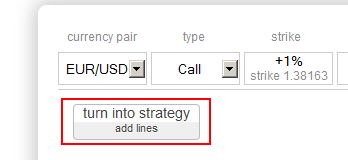

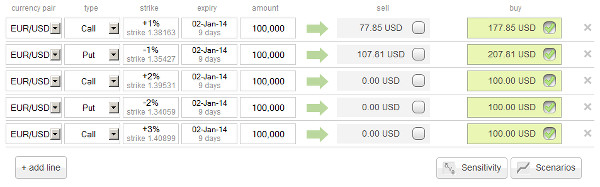

You can also create options strategies in Advanced mode:

A strategy is comprised of two or more call/put options with variable strike levels and sizes:

You can read more about popular options strategies on Wikipedia.

Switching back to basic custom trade screen is easy:

If you get lost or simply need some help on the platform’s interface or the basics of options trading, you can always see an educational tutorial by switching Educate button to ON:

Trading instruments

There are two types of options currently available for trading:

All contracts traded on https://www.optionsreasy.com/EarnForex/

Uncovered sale of options is not available at this moment. Which means that you cannot sell a call or a put unless you already own such a contract. This prevents some of the advanced options strategies from working, but helps traders to avoid infinitely large losses associated with

How to trade?

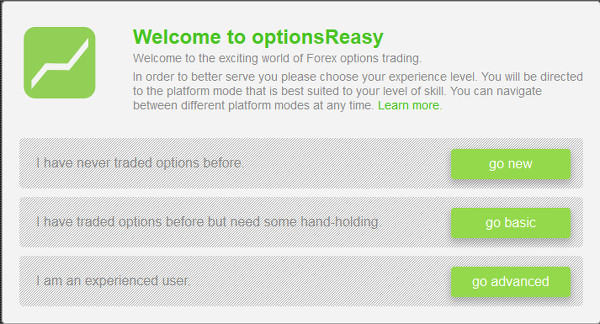

Opening a trade is easy. Here I will provide three example trades. One in the

Examples

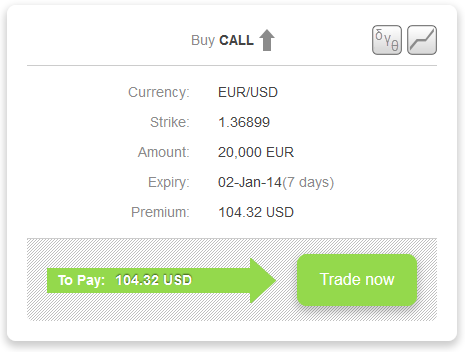

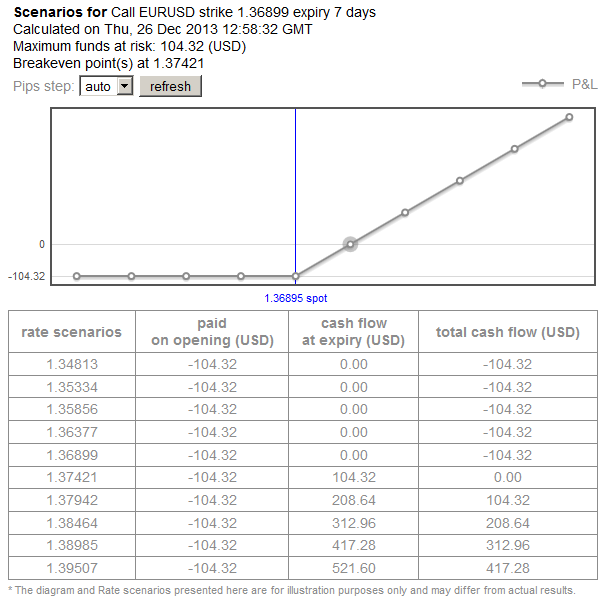

Bullish trade on EUR/USD (

Here I am buying a call option for 20,000 EUR/USD at the strike price of 1.36899 with expiration set to January 2, 2014 (7 days from now), with the current spot rate at 1.36910 for $104.32. This basically means that I am buying a right (but not obligation) to buy â¬20,000 (or 0.2 standard Forex lot) at $1.36899 per euro on January 2, 2014:

Resulting position:

![]()

If the price is above 1.37421 at expiration, I am getting large enough profit to compensate the options contract’s price. Possible outcomes are generated by the trading platform:

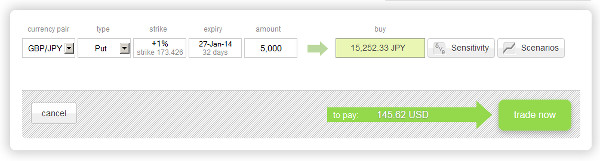

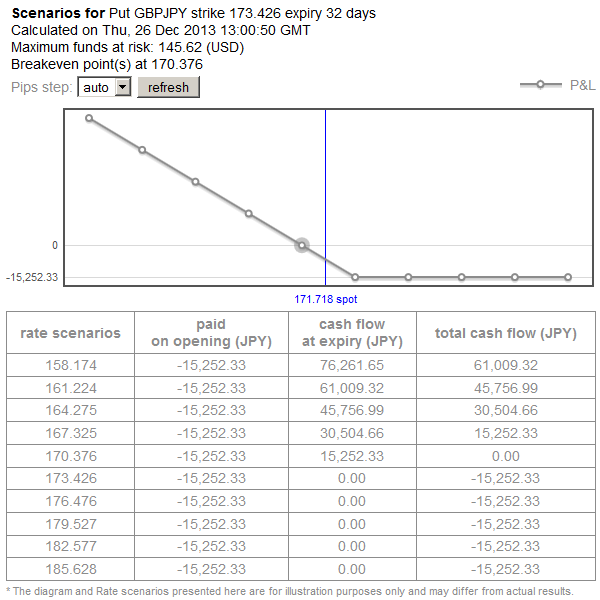

Bearish trade on GPB/JPY (Basic mode)

In this example, I am buying a put option for 5,000 GBP/JPY at the strike price of 173.428 with expiration on January 27, 2014 (32 days from now), with current spot rate at 171.718 for ¥15,252.33 ($145.62). This means that I am buying a right (without obligation) to sell £5,000 (or 0.05 standard Forex lot) at ¥173.428 per British pound on January 27, 2014:

Resulting position:

![]()

If the currency rate expires below 170.376, this put option will yield enough profit to cover its cost. Other possible outcomes of this trades include:

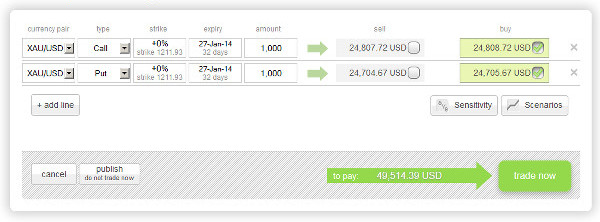

Straddle strategy in XAU/USD (Advanced mode)

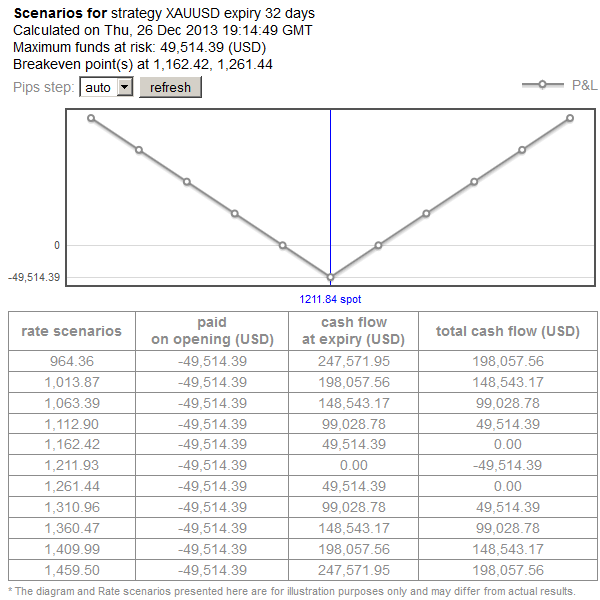

Straddle is an option contract that benefits from a significant move in any direction. In straddle, you buy a call and a put at the same strike price with the same expiration and of the same size. As a result, your maximum loss on both sides is limited, and any significant excursion of the price level from the entry point rewards a trader proportionally to extent of that movement.

Here is an example of a straddle position in Gold (XAU/USD). I buy a call and a put for 1,000 troy ounces at the strike price of 1,211.93 with expiration in 32 days (on January 27, 2014) with the current spot rate at $1,211.84/ounce. The call price was $24,808.72, for put — $24,705.67, the total price was $49,514.39:

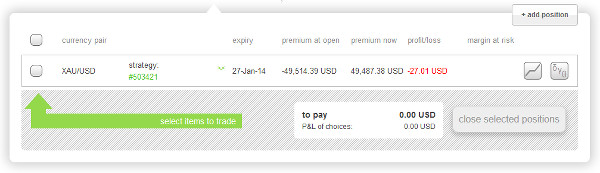

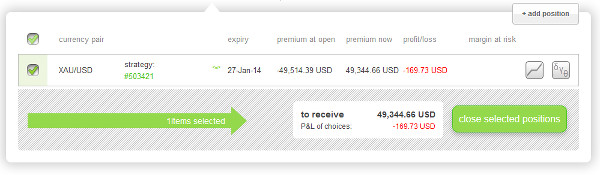

Resulting position:

If the Gold trades below $1,162.42 or above $1,261.44 on January 27, 2014, I will earn enough profit to cover the price of two options contracts that I have bought. If it goes even far below (or above), I will earn $1,000 per every $1 of difference:

How to close a position?

Closing a position is very simple. You just check the position you want to close and click a close selected positions button:

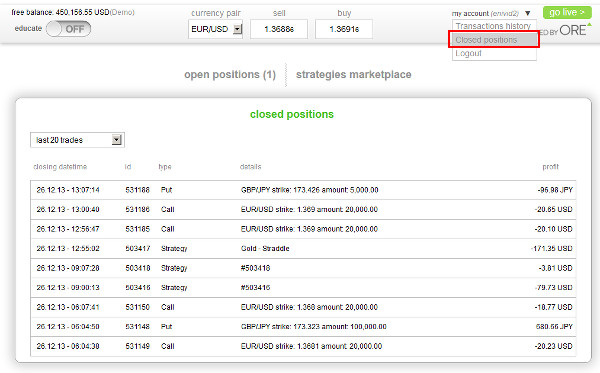

You can view the list of closed positions anytime by clicking Closed positions link in the account

Account statements

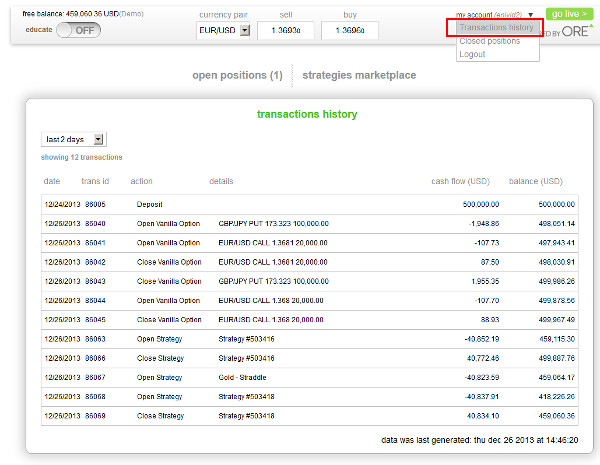

There are no advanced account statements at this moment, but, in addition to the previously mentioned closed positions list, you can also view a transaction history. It contains a list of all transactions performed in your account. You can select a time period to see the report for and a detailed info on each transaction, including deposits/withdrawals:

Going live?

Right now, the only Forex broker offering live accounts with optionsReasy platform is

Strategies marketplace

There is more features in our optionsReasy platform than I have described here, but I will try to cover them in future posts. For example, there is a rather convenient marketplace (free, of course) for various options strategies (combinations of calls and puts) generated by other traders. But I will write about it only if our newly launched options platform attracts enough interest from the site’s visitors.

If you have any questions about optionsReasy platform or if you would like to share your opinion about it or options trading in general, please feel free to do so using the commentary form below.