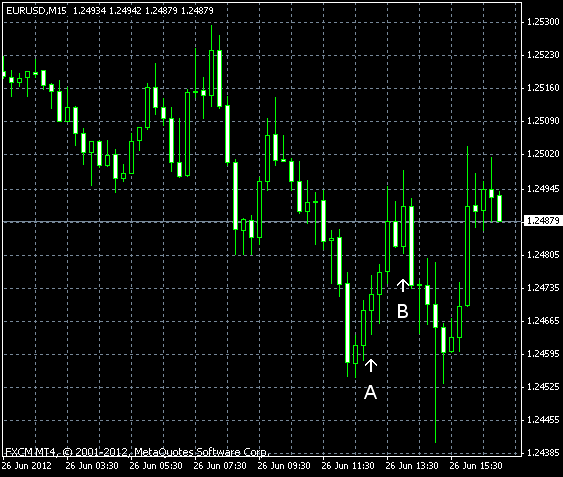

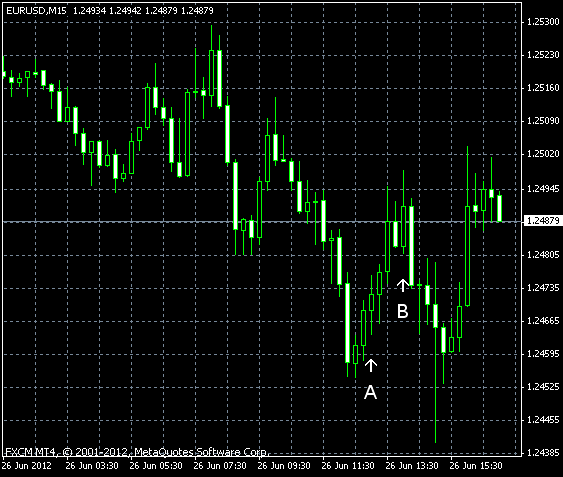

EUR/USD dropped today as borrowing costs surged on today’s Spanish and Italian debt auctions. The currency pair trimmed its losses as poor fundamental data from the United States spurred speculations that QE3 may be imminent. Housing data was actually not bad, but manufacturing and consumer sentiment reports were unexpectedly poor.

S&P/

Richmond Fed manufacturing index unexpectedly fell from 4 in May to -3 in June. The average estimate of analysts promised the index to stay flat at 5. (Event B on the chart.)

Consumer confidence was at 62.0 in May, lower than economist have hoped for (63.8). Moreover, the previous value was revised from 64.9 to 64.4. (Event B on the chart.)

Yesterday, a report was released, showing that new home sales were at the seasonally adjusted annual rate of 369k in May. Market participants expected just a little change from 343k to 347k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.