The dollar fell against the euro today after the FOMC released its monetary policy statement showing that the stimulus

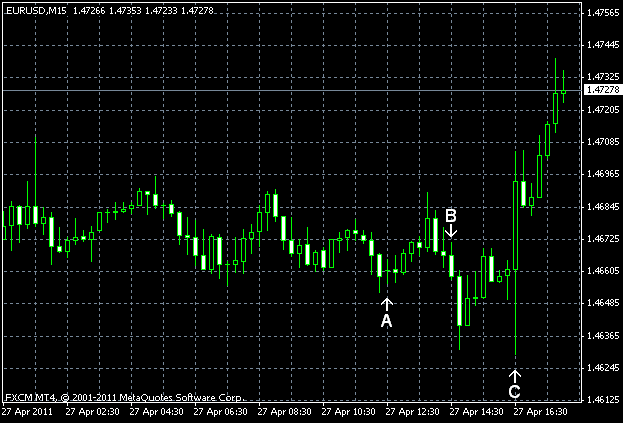

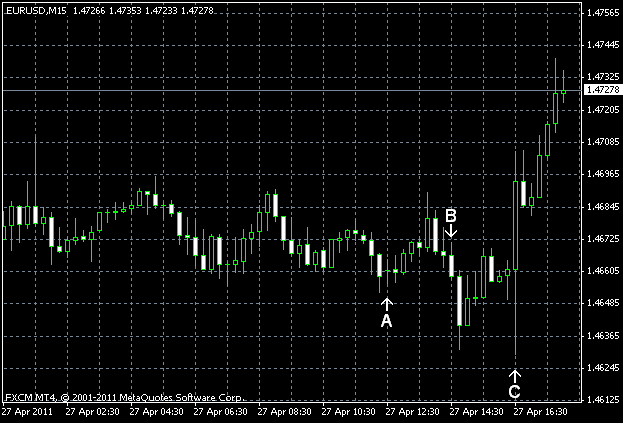

Durable goods orders increased by 2.5% in March, following 0.7% increase in February (revised up from 0.9% decline). The forecast for this fundamental indicator was at 2.3% (Event A on the chart.).

US crude oil inventories added 6.2 million barrels last week after falling by 2.3 million barrels a week earlier. Total motor gasoline inventories decreased by 2.5 million barrels during the same period, following 1.5 million drop (Event B on the chart.).

Federal Open Market Committee released its policy statement today, confirming the federal funds rate target at between 0% and 0.25%. The “moderate” pace of economic recovery was cited and it was stated that the $600 billion treasuries buying program will be finished by the end of the second quarter of this year (Event C on the chart.):

In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and will complete purchases of $600 billion of

If you have any comments on the recent EUR/USD action, please reply using the form below.