President of the European Central Bank

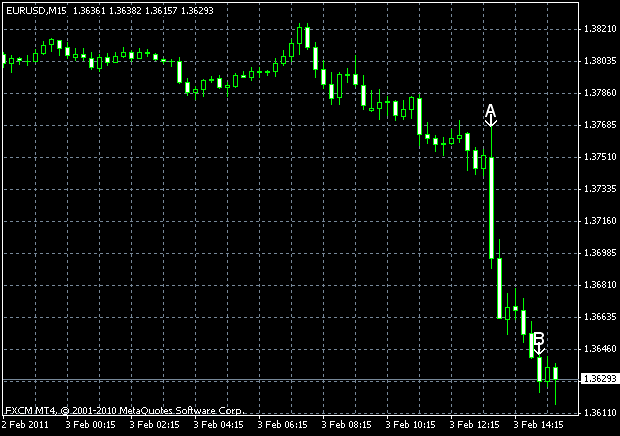

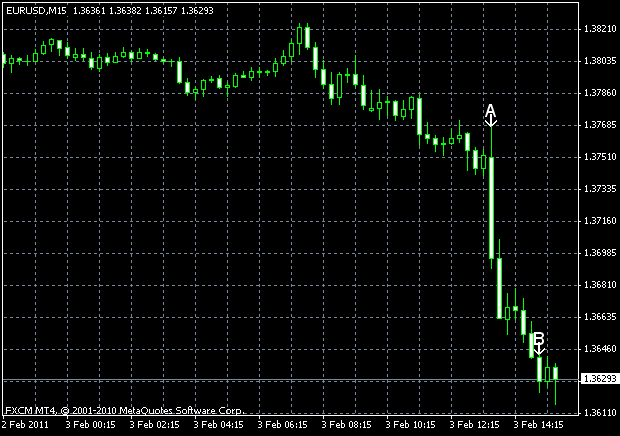

Initial jobless claims decreased to 415k last week from the previous week’s revised figure of 457k. Market participants expected a decrease to 420k. (Event A on the chart.)

US nonfarm productivity increased at a 2.6% annual rate during the fourth quarter of 2010, compared to the 2.4% growth in the third quarter. Market counted on lesser productivity of 2.1%. (Event A on the chart.)

ISM services rose to 59.4 in January as economic activity in the

Factory orders posted an increase by 0.2% in December, surprising Forex analysts who expected a decline by the same 0.2% rate after an advance by 1.3% (revised from 0.7%) in November. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please, reply using the form below.