To get the Asia AM Digest every day, SIGN UP HERE

Sentiment-linked currencies like the Australian and New Zealand Dollars rallied on Tuesday alongside stocks which were up in Asia, Europe and the US. The improved mood arguably began when China’s President Xi Jinping spoke at the Boao Forum for Asia early into the session. There, Mr. Jinping not only emphasized pushing for free trade, but also intentions to retaliate against additional US tariff proposals were notably absent.

The upbeat mood as trade war fears ebbed continued into the US session where President Donald Trump responded positively to Xi Jinping’s speech. Mr. Trump thanked him on his ‘kind words’ on tariffs, adding that ‘we will make good progress together’. Anti-risk currencies like the Japanese Yen and Swiss Franc declined as demand for safety fell.

Meanwhile the Canadian Dollar also outperformed on Tuesday as crude oil rose by the most since early March. Oil prices were boosted by news that Saudi Arabia wants the commodity at $80 a barrel to help pay for the government and to support Aramco before an IPO. As a result, USD/CAD is now quickly approaching the target of a bearish reversal pattern.

The Euro swung today between gains and losses. First, it was pushed higher by comments from ECB’s Ewald Nowotny who gave his argument for lifting the deposit rate to -0.2% from -0.4%. However, a couple of hours later the central bank stepped in and reminded the markets that Nowotny’s views don’t represent the governing council. That caused the Euro to give up some of its prior gains.

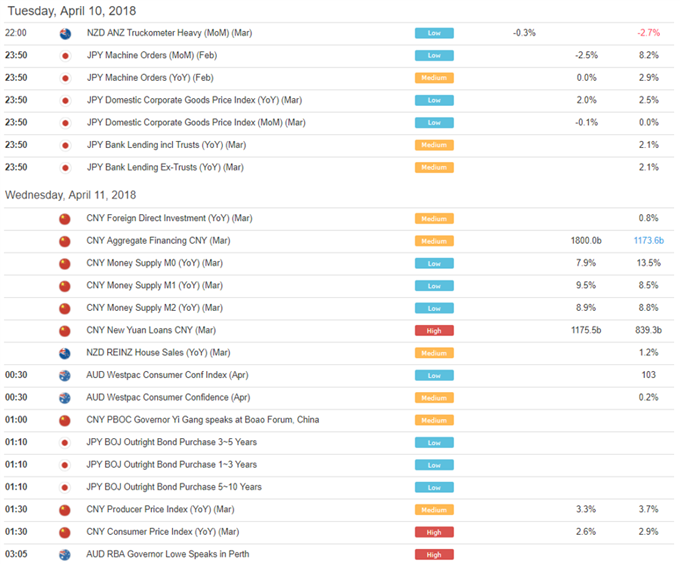

Looking ahead, there is a chance that the unscheduled Chinese new yuan loans data could cross the wires later today. We will also get their CPI and PPI statistics for March. Data out of the country has been deteriorating relative to economists’ expectations as of late and more of the same could hurt the Australian Dollar. AUD/USD is slowly inching towards a critical resistance area and we shall see if it may hold.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

![]()

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 51.7% of AUD/USD traders are net-long with the ratio of traders long to short at 1.07 to 1. In fact, traders have remained net-long since Mar 22 when AUD/USD traded near 0.76892; price has moved 0.9% higher since then. The percentage of traders net-long is now its lowest since Mar 26 when AUDUSD traded near 0.77451. The number of traders net-long is 18.7% lower than yesterday and 3.5% lower from last week, while the number of traders net-short is 32.3% higher than yesterday and 2.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- US Dollar Price Action Setups Ahead of CPI, FOMC Minutes by James Stanley, Currency Strategist

- Ichimoku Charts That Matter: USD Weakness Pauses, Clouds Expect More by Tyler Yell, CMT, Forex Trading Instructor

- GBP/JPY Price Analysis: Rally Testing Key Resistance Barrier by Michael Boutros, Currency Strategist

- Canadian Dollar Rate Forecast: CAD Rides Commodity Boostby Tyler Yell, CMT, Forex Trading Instructor

- EUR/USD, GBP/USD Bounce From Support as USD Bears Remain In-Controlby James Stanley, Currency Strategist

To get the Asia AM Digest every day, SIGN UP HERE

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

To receive Daniel‘s analysis directly via email, please SIGN UP HERE