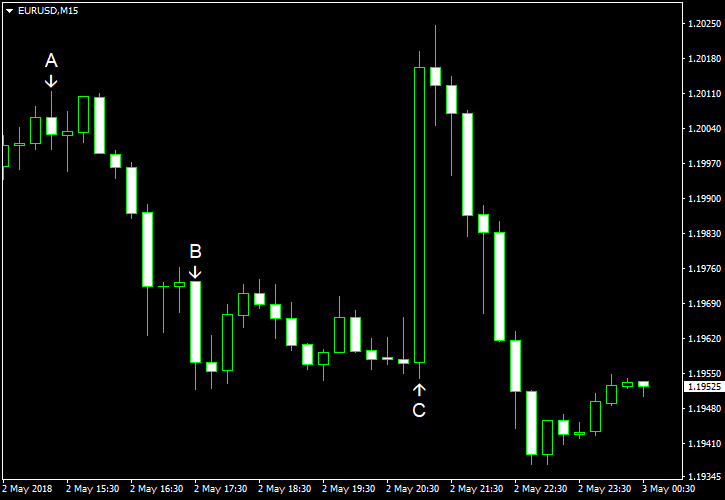

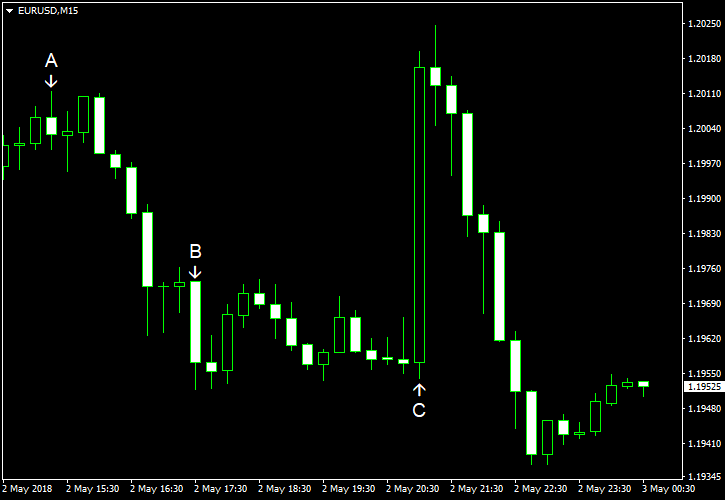

EUR/USD was very volatile after the release of a policy statement by the Federal Open Market Committee. The currency pair leaped after the release but immediately started to back off and went below the opening level after some time. Market analysts thought that the FOMC made some dovish changes to the statement, and that was the reason for the initial jump. Yet it looked like the outlook for monetary policy did not change substantially as market participants were still counting on a June rate hike.

ADP employment rose 204k in April from March on a seasonally adjusted basis, in line with market expectations. The March increase was revised lower from 241k to 228k. (Event A on the chart.)

US crude oil inventories rose 6.2 million barrels last week, way more than analysts had anticipated — 1.0 million. Still, the stockpiles remained in the lower half of the average range for this time of year. The week before, the reserves were up 2.2 million. Total motor gasoline inventories rose by 1.2 million barrels. (Event B on the chart.)

FOMC left the target range for the federal funds rate at 1.5%-1.75% as was widely expected. (Event C on the chart.) Overall, it did not seem that the Committee wants to accelerate the pace of policy normalization, reiterating:

The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.

If you have any comments on the recent EUR/USD action, please reply using the form below.