To get the Asia AM Digest every day, SIGN UP HERE

A Look Ahead – The Oil Conundrum

Crude oil prices may succumb to some volatile price action as the new week gets under way. Over the weekend, Iran came out against higher oil prices. Deputy Oil Minister Amir Hossein Zamaninia said that a “suitable price” for oil is $60 to $65 per barrel. Oil Minister Bijan Namdar Zanganeh also said that the country supports “reasonable” prices. This may depress prices in the near-term.

However, Donald Trump’s new lawyer Rudolph Giuliani hinted that the president may pull out of the Iran Nuclear Deal. Speaking at a convention during the weekend, he pointed out the presence of National Security Adviser John Bolton and Secretary of State Mike Pompeo as being key in the president’s inner circle. This presents as an argument for oil to rise.

Prior Session Recap – USD Swings on NFPs, NZD Lower

To say that the US Dollar’s reaction on April’s local jobs report was volatile is an understatement. At one point, the currency initially touched a session low before reaching a session high within a span of an hour or so. This may have been due to a mixed release where the unemployment rate fell to its lowest since 2000 while average hourly earnings missed expectations. In the end, the currency finished Friday little changed, perhaps due to some profit taking.

Meanwhile the New Zealand Dollar ended the day cautiously lower against its major counterparts. The RBNZ and FMA (Financial Markets Authority) issued a letter to banks requiring them to report to regulators by May 18 about how they address behaving ethically. Governor Adrian Orr and FMA’s Chief Executive Rob Everett hinted that they may reserve the right to conduct on-site monitoring. Perhaps the threat of what could be increased regulation saw Kiwi Dollar traders look for opportunities elsewhere.

US and China trade discussions ended in some discord. The former wants the latter to reduce its trade deficit with the US by $200 billion by the end of 2020. China’s official Xinhua News Agency reported that there were major disagreements on some matters. President Donald Trump tweeted that they will be meeting to discuss the talks so keep an eye out for more developments on this front.

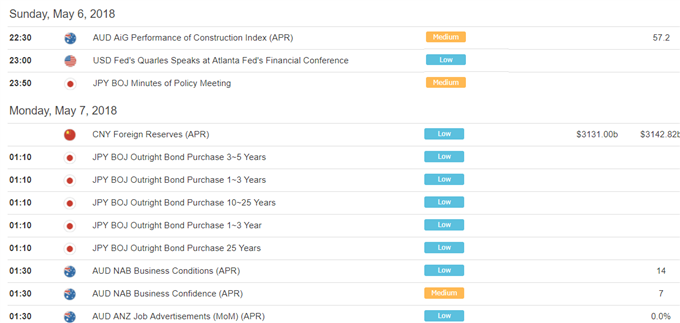

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

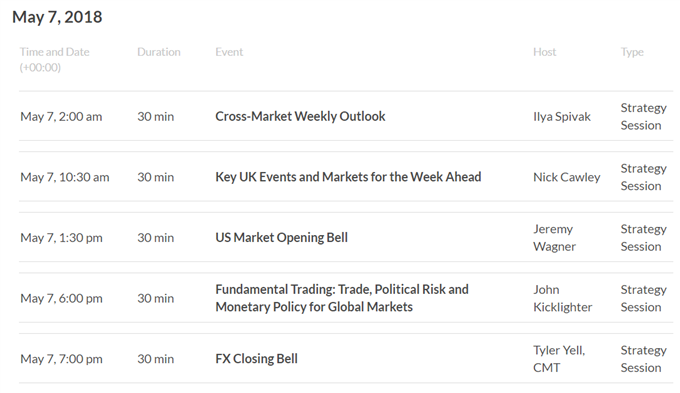

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

![]()

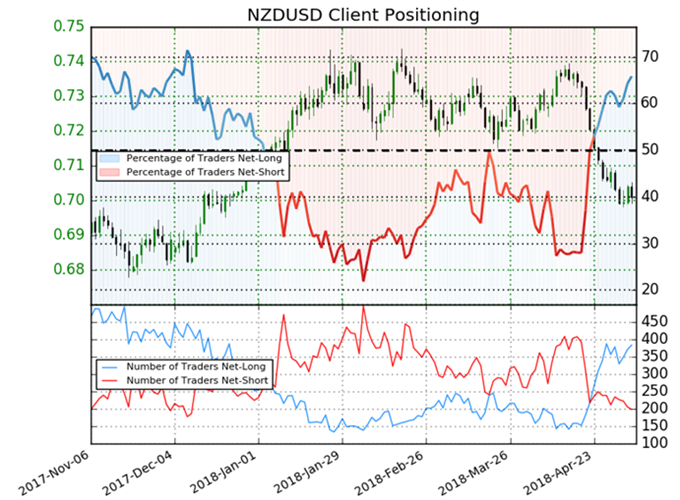

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 65.9% of NZD/USD traders are net-long with the ratio of traders long to short at 1.93 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.71535; price has moved 2.0% lower since then. The percentage of traders net-long is now its highest since Nov 16 when NZD/USD traded near 0.68549. The number of traders net-long is 6.4% higher than yesterday and 5.8% higher from last week, while the number of traders net-short is 2.9% lower than yesterday and 17.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

![]()

![]()

![]()

Five Things Traders are Reading:

- Why EUR/USD and GBP/AUD Qualify as Appealing Trade Opportunities by John Kicklighter, Chief Currency Strategist

- Dollar Ends Week Steady and S&P 500 Strong, BoE Top Event Risk Ahead by John Kicklighter, Chief Currency Strategist

- Japanese Yen May Gain if Uncertainty On Iran Deal Hurts Sentiment by Daniel Dubrovsky, Junior Analyst

- Sinking Australian Dollar Can’t Look For Support In The Numbersby David Cottle, Analyst

- Yuan May Lose on Weak Exports, Gain on Warmer China-Japan Relationsby Renee Mu, Currency Analyst

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

To receive Daniel‘s analysis directly via email, please SIGN UP HERE