Current Market Developments – CAD Up on NAFTA News, USD Rises on ZTE Ban Alternative

As the FX markets transitioned into Tuesday’s session, the Canadian Dollar cautiously rose against its major counterparts. The currency was bolstered by a statement from Canada’s Prime Minister Justin Trudeau about NAFTA talks. According to the note, he and US President Donald Trump discussed the possibility of bringing negotiations to a prompt conclusion. This removes some uncertainty around the deal to a certain extent as reaching the May 17th deadline set by House Speaker Paul Ryanlooks more likely.

Meanwhile the US Dollar advanced towards the end of Monday as Commerce Secretary Wilbur Ross reported that the country would consider alternatives to the ZTE ban. This would be a U-turn from when the Commerce Department banned companies from providing to ZTE last month. China welcomed this news and the potential for trade war disputes seemed to have deescalated.

A Look Ahead – Australian Dollar Faces RBA and China Data

During Tuesday’s Asian session, we will get the RBA May meeting minutes. The Australian Dollar did gain in the aftermath of their monetary policy announcement this month when they raised inflation forecasts for this year. More of the same tone could potentially bode well for the Australian unit. However, keep in mind that Deputy Governor Guy Debelle reiterated that there is a no strong case for a near-term

Shortly after, we will then get Chinese retail sales and industrial production. Since China is Australia’s largest trading partner, economic performance in the former can often imply knock-on effects on the latter. However, if Australia’ central bank is adamant on holding rates for now, then long-term implications from the data could be lacking for the Aussie Dollar.

Prior Session Recap – New Zealand Dollar Down and British Pound rises

The New Zealand Dollar resumed its decline after consolidating in the aftermath of a relatively dovish RBNZ rate decision. It fell along with local government bond yields, signaling ebbing hawkish monetary policy expectations. Meanwhile, the British Pound was arguably the best performing major, though some of its gains evaporated as the US Dollar rose towards the end of the session.

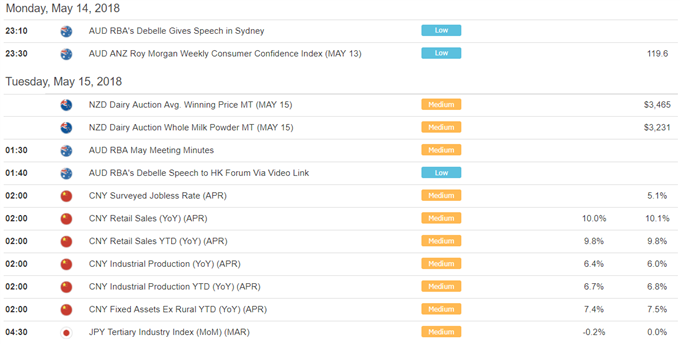

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

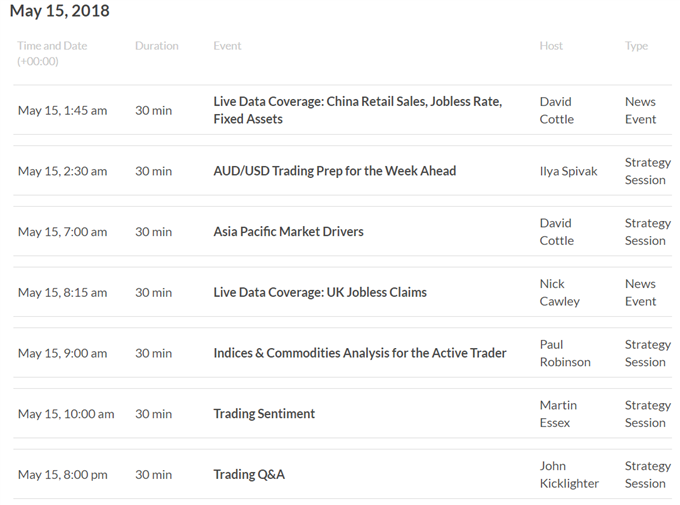

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

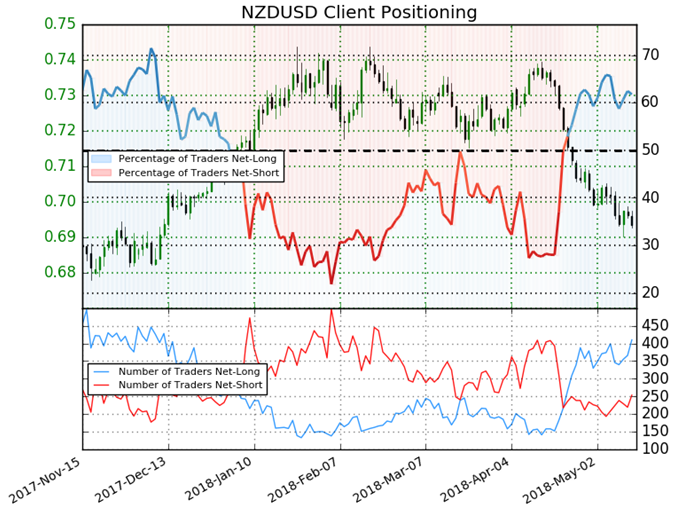

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 61.7% of NZD/USD traders are net-long with the ratio of traders long to short at 1.61 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.72044; price has moved 3.7% lower since then. The number of traders net-long is 12.0% higher than yesterday and 1.9% lower from last week, while the number of traders net-short is 13.9% higher than yesterday and 16.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- Crude Oil Price Forecast: Oil Leads As OPEC Boosts Demand Forecast by Tyler Yell, Forex Trading Instructor

- NZD/USD Remains Under Pressure Ahead of New Zealand Budget Statement by David Song, Currency Analyst

- FX Markets Turn to US Retail Sales, EZ, Canada, Japan CPIby Christopher Vecchio, Sr. Currency Strategist

- Gold Prices Bounce to Resistance while Dollar Index Correctsby Jeremy Wagner, CEWA-M, Head Forex Trading Instructor

- Canadian Dollar Rate Forecast: Oil and Key Data May Help CAD Further by Tyler Yell, Forex Trading Instructor

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter