EURUSD Talking Points

– US Treasury yields remain near multi-year highs.

– Growing Italian political fears will continue to weigh on the Euro.

Check out our new Trading Guides: they’re free and have been updated for the second quarter of 2018.

IG Client Sentiment data show 55.4% of traders are net-long EURUSD with the ratio of traders long to short at 1.24 to 1. Download the free guide and see what client changes mean and how you can use them when trading.

EURUSD Remains Weak and the Down Trend is Still Dominant

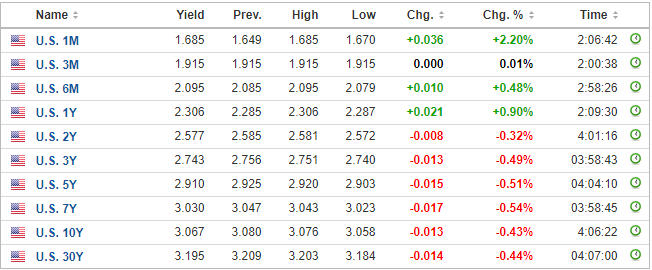

A combination of a weak Euro and a strong US dollar will continue to weigh on EURUSD although the pair may stage a small recovery in the short-term after recent sharp losses. While the 10-year break above 3.0% may have caused the most headlines, the 7-year UST now offers 3.03%, a level last seen in 2010, while the 5-year is quoted at 2.91%, levels last seen in 2008. Tuesday’s US retail sales matched expectations at 0.3% in April while the prior month’s number was upgraded to 0.8% from 0.6% adding to expectations that Q2 US growth may be stronger than first thought.

US Treasury Yields – May 16, 2018

In contrast, the single currency remains under pressure as the market waits for the outcome of discussions between Italy’s Five Star Movement and the Northern League. While the two parties seek to try and finalise a ruling government, unconfirmed reports are circulating that they may be seeking to renegotiate EU financial rules as well as Italy’s budget contributions and look for the ECB to forgive EUR250 billion of Italian debt. Italian bond yields rose Wednesday with the 10-yer touching a two-month high of 2% as investors continue to price in heightened risk.

EURUSD remains weak and any pull-back may be seen as a fresh opportunity to short the pair. With the January 9 swing low at 1.19140 a potential short-term set-up. Above there the 200-day moving average at 1.20500 may prove tough resistance to break through. On the downside, the swing lows at 1.17175 and 1.15540 look likely targets.

EURUSD Daily Price Chart (August 29, 2017 – May 16, 2018)

Would you like to know the Number One Mistake Traders Make? – Download our free guide to find out.

If you have questions or comments on this article, you can leave them in the section below, or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1.

— Written by Nick Cawley, Analyst