Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA +0.9%, Nasdaq 100 +0.8%, S&P 500 +0.5%

Major Headlines

- US-China Trade War is on hold amid progress in talks

- Italy’s 5 Star and League Party are seeking President Mattarella’s backing on PM

USD: The greenback beginning the week firmer, continuing to make a move towards the December highs at 94.22. This morning, the US Dollar pushed through 94.00, reaching a high of 94.06 with support from fading US-China tariff threats. Treasury Secretary Mnuchin stated that a trade war will be put on hold following a round of progressive talks in which China stated they would purchase more US exports. Subsequently, this saw a lift in risk sentiment, prompting safe-haven currency selling with USDJPY now consolidating above 111.

GBP: Ahead of a busy week for GBP trader, the Pound is on the backfoot this morning with political uncertainty continuing to pressure the currency. UK newsflow remains GBP bearish with weekend reports noting that some Conservative MPs are said to be preparing for the possibility of a snap election in Autumn amid Brexit stalemate, while SNP’s Sturgeon pledged to restart her campaign for Scottish independence. As such, GBPUSD saw a brief dip below the 1.34 handle to trade at its lowest level in 5-months, which prompted a push higher in the FTSE 100, which typically has an inverse relationship, subsequently, the FTSE rose to a fresh record.

AUD: The Australian Dollar received renewed support after the US and China appeared willing to hold back on initial trade tariffs having signalled that a possible trade deal may come to fruition. This development reduces the risk of softening global demand on the back of potentially lower industrial output from China and therefore supports the Australian Dollar given its large exposure to the nation. In turn, this reaffirms the view for AUDNZD to make a push towards the 1.10 handle having reclaimed 1.09, which is could lead to AUDUSD consolidating above 0.7500.

EUR: The Euro remains subdued amid the political uncertainty in Italy, EURUSD briefly broke through 1.1750 to move towards lows of the day at 1.1717. However, heavy buying interest above 1.17 and a huge 1bln option expiry at 1.1760 have curbed any further losses in the pair for now.

DailyFX Economic Calendar: Monday, May 21, 2018 – North American Releases

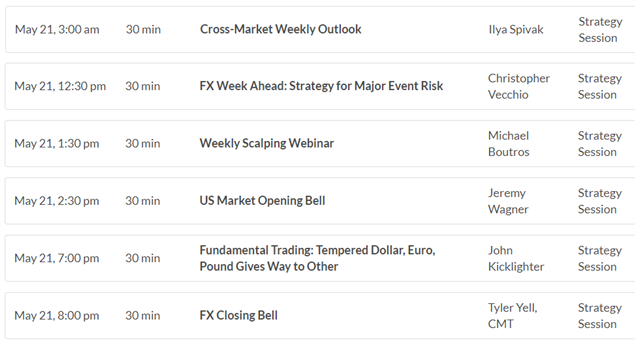

DailyFX Webinar Calendar: Monday, May 21, 2018

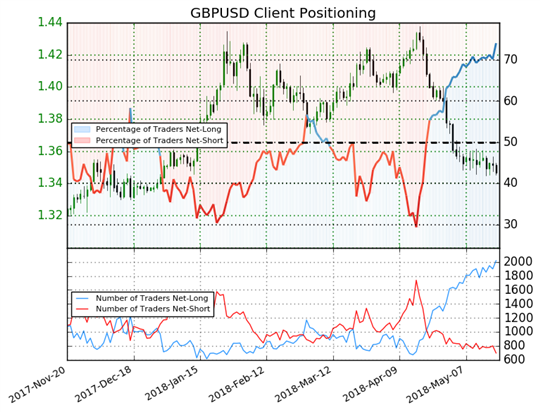

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 74.1% of traders are net-long with the ratio of traders long to short at 2.86 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.4337; price has moved 6.1% lower since then. The number of traders net-long is 5.3% higher than yesterday and 15.5% higher from last week, while the number of traders net-short is 14.0% lower than yesterday and 7.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

Five Things Traders are Reading

- “Australian Dollar Rises as US-China Trade War is Put on Hold” by Justin McQueen, Market Analyst

- “Euro Forecast: EUR/USD Decline May Not Be Finished”by Christopher Vecchio, Senior Currency Strategist

- “Silver Technical Analysis: Confluence of Support May Soon Break”by Paul Robinson, Market Analyst

- “CoT Update: Speculators Selling as Crude Oil Rallies” by Paul Robinson, Market Analyst

- “US China Trade War & a Brief History of Trade Wars – 1900 until Present”by John Kicklighter, Ilya Spivak, Christopher Vecchio and Renee Mu

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX