Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA +0.2%, Nasdaq 100 +0.4%, S&P 500 +0.2%

Major Headlines

- China slashes import tariffs on autos

- BoE’s Vlieghe sees 1 or 2 rate hikes per year as appropriate

- Italy’s 5 Star and League leaders are seeking EU critic Savona as Economy Minister

EUR: The had been firmer for much of the morning, reaching a high of 1.1829 on the back of falling Italian bond yields. However, the Euro later reversed gains after reports that the 5 Star and League leader are seeking Paolo Savona as the Economy Minister, someone who has been somewhat critical about the EU. EURUSD to continue to remain supported above 1.17, while YTD lows reside at 1.1717.

GBP: This morning, four BoE speakers (Carney, Saunders, Ramsden and Vlieghe) discussed the latest inflation report at the Treasury Select Committee with the most notable comment coming from Vlieghe, stating that noting that interest rates are likely to rise around 0.25%-0.50% over the 3yr forecast period. Subsequently, this nudged GBP higher, however fell short of breach 1.35, market pricing largely unchanged post the TSC with focus on the upcoming key data points.

AUD: The Australian Dollar remains supported amid the easing of trade tensions between the US and China, AUDUSD above 0.7600 briefly. Reports earlier today stated that China are to cut import tariffs on autos in a sign that US and China could be heading towards a potential trade agreement. AUDNZD pressing higher for better levels, 1.10 remains the near-term target on the upside.

DailyFX Economic Calendar: Tuesday, May 22, 2018 – North American Releases

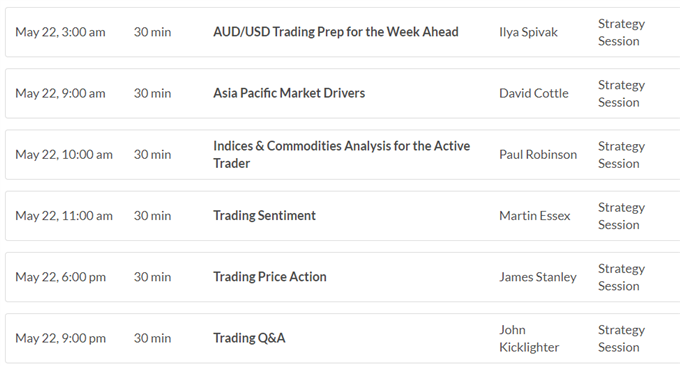

DailyFX Webinar Calendar: Tuesday, May 22, 2018

Five Things Traders are Reading

- “US Dollar Drop to Support Produces Setups on Both Sides of USD” by James Stanley, Currency Strategist

- “Market Sentiment Data: Bearish Signals for GBP, Gold and Bitcoin”by Martin Essex, MSTA , Analyst and Editor

- “Trading Outlook for Gold Price, Crude Oil, FTSE & More”by Paul Robinson, Market Analyst

- “USDJPY Bulls in Driving Seat Amid Reduced Trade War Concerns” by Justin McQueen, Market Analyst

-

“

Ethereum & Ripple Chart Patterns Point to Potentially Strong Moves”

by Paul Robinson, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX