Receive the DailyFX US AM Digest in your inbox every day before US equity markets open – signup here

US Market Snapshot via IG: DJIA -0.7%, Nasdaq 100 -0.9%, S&P 500 -0.6%

Major Headlines

- UK Inflation falls below expectations at 2.4% (Exp. 2.5%)

- Eurozone and German PMI miss estimates signaling moderating growth

- Trump expresses doubts over upcoming US-NK Summit

GBP: The posted fresh 2018 lows this morning, testing 1.33 to the downside after softer than expected inflation figures, with the headline reading dipping to 2.4% vs. 2.5% expected. As such, a fresh wave of GBP selling had been seen, given that lower inflation reduces the necessity for the Bank of England to raise rates. Subsequently, this had been reflected in OIS markets (Overnight Index Swaps) whereby pricing for a rate hike in August fell to 33% from 40%, while bets for a November rate hike fell to 72%.

EUR: Weak PMI surveys from the Eurozone and Germany has added further pressure to the Euro today, which continues to face uncertainty amid the concerns surrounding Italian politics. German PMI’s initiated the losses this morning in which private sector growth slowed to its lowest level in 20-months. The latest on the Italian political front, President Mattarella has asked the inexperienced Conte to try and form a government, worries are whether the EU critic Savona will be picked for the role of Economy Minister. Nevertheless, Euro selling looks set to continue as option pricing suggests further downside for EURUSD with demand for put options over calls at the highest since February.

JPY: Risk off sentiment dominates the FX space, consequently supporting safe-havens, JPY and CHF, while the rout in Emerging Markets currencies continue as TRY plunge relents. Overnight comments from President Trump who expressed doubts over the NK-US summit, sparking the initial buying in the JPY with cross selling in EURJPY and GBPJPY throughout the European morning seeing gains extended.

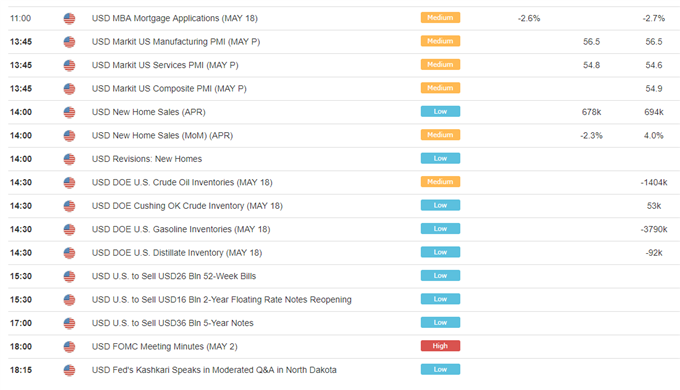

DailyFX Economic Calendar: Wednesday, May 23, 2018 – North American Releases

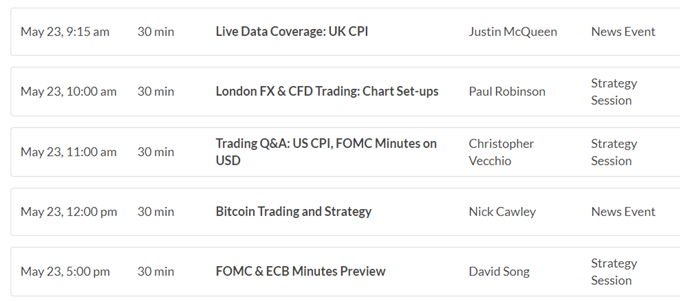

DailyFX Webinar Calendar: Wednesday, May 23, 2018

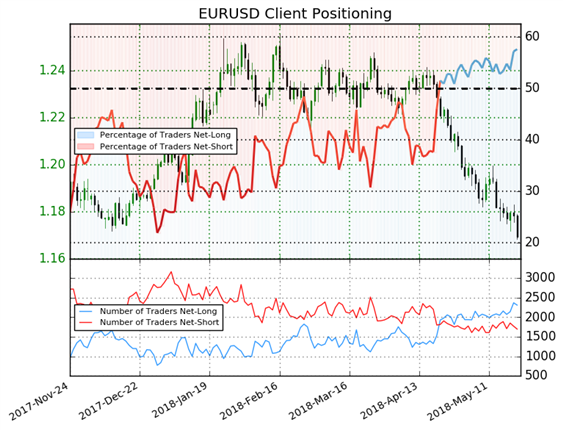

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 57.6% of traders are net-long with the ratio of traders long to short at 1.36 to 1. In fact, traders have remained net-long since Apr 30 when EURUSD traded near 1.21294; price has moved 3.6% lower since then. The number of traders net-long is 2.3% higher than yesterday and 2.2% higher from last week, while the number of traders net-short is 11.2% lower than yesterday and 7.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Five Things Traders are Reading

- “US Dollar Back to 2018 Highs as Equities Take a Bearish Turn” by James Stanley, Currency Strategist

- “Cryptocurrencies – The Bears are Growling | Webinar”by Nick Cawley, Market Analyst

- “Technical Outlook for EUR/USD, GBP/USD, JPY-Crosses, Gold & More”by Paul Robinson, Market Analyst

- “UK Inflation Report: GBP Outlook Driven by CPI in Near-Term | Webinar” by Justin McQueen, Market Analyst

- “FTSE Chart Analysis – Decline from New High May Be Just Getting Started” by Paul Robinson, Market Analyst

The DailyFX US AM Digest is published every day before the US cash equity open – you can signup here to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open – you can SIGNUP HERE to receive that report in your inbox every day.

If you’re interested in receiving both reports each day, you can SIGNUP HERE.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX

https://www.dailyfx.com/sentiment?ref-author=mcqueen