Oil Price News and Analysis

– Demand for oil may be pared back next year.

– OPEC and Russia discuss supply boost to offset producer disruptions.

The new DailyFX Q2 Oil Forecast is now available to help traders navigate the market.

Brent Crude Price Slips but Underpinned at Lower Levels

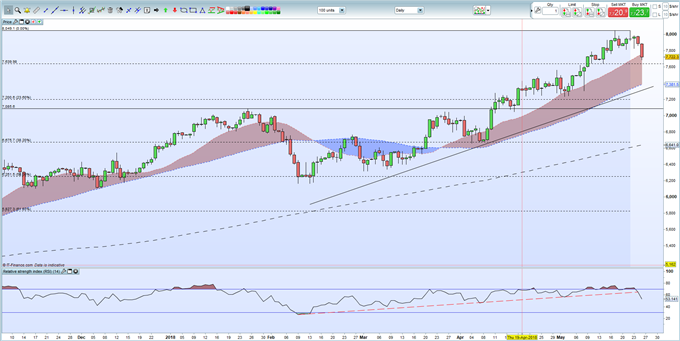

The price of Brent crude oil has found $80/bbl. tough resistance to break and is now trading at levels last seen 10 days ago as producer talk suggests that higher supply and lower demand may lie ahead. Technical support currently sits around $1 lower but a break of this would leave $72/bbl. a real possibility.

Over the last 24 hours, commentary from OPEC, Russia and Saudi Arabia has weighed on oil prices and given a nudge towards a re-balancing of the supply/demand situation. Energy ministers from Russia and Saudi Arabia and the UAE are considering making up the shortfall from the drop in Venezuelan production, along with the expected shortfall from Iran. The Saudi Arabian energy minister also said Friday that oil demand will moderate in 2019 after growing by 1.5 million barrels per day in 2018.

A look at the daily oil chart shows that $80/bbl. is currently capping the upside, although the strong uptrend remains in place. The May 10 and 14 lows of $76.40/bbl. provide the first level of support before the Fibonacci retracement at $72/bbl. comes into play. A break below this level would need a strong catalyst. The RSI indicator uptrend from mid-February has been broken to the downside and may also suggest lower oil prices. On the upside $80/bbl. is likely to provide strong resistance. It seems we may be forming a trading range for the next few weeks.

Traits of Successful Traders and Top Trading Lessons are two of DailyFX’s most popular trading guides.

Brent Crude Price Chart Daily Time Frame (November 8, 2017 – May 25, 2018)

Are you new to Oil or FX trading or are you looking to improve your trading skill sets?

We can help you along your journey with a comprehensive range of constantly updated guides and trading tools – they are all Free to Download Here.

What’s your opinion on Brent Crude?Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at nicholas.cawley@ig.com or via Twitter @nickcawley1.

— Written by Nick Cawley, Analyst