EURUSD News and Talking Points

– US data is likely to dominate EURUSD for the rest of the week.

– Italian and Spanish politics still firmly in-play.

The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions.

EURUSD Sell-off Stalls but Renewed Weakness Likely

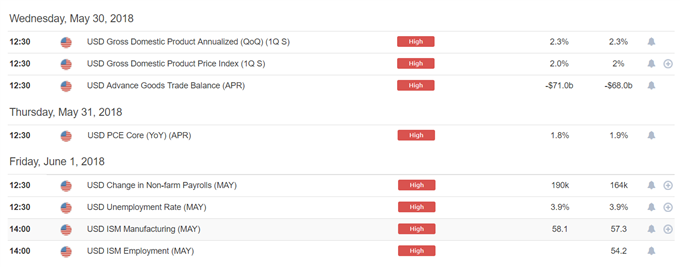

EURUSD remains weak but with the Italian political crisis moving, temporarily, to the background, the pair will now be driven by heavyweight US data and tonight’s release of the Federal Reserve’s Beige Book. Today’s second revision of US Q1 GDP may show a slight revision to the upside, while tonight’s Beige Book release may well highlight a tightening US labour market which may force companies to raise wages or increase hiring. On Thursday the latest PCE core reading, the Fed’s preferred inflation measure, is seen nudging lower to 1.8% – below but still close to the central bank’s 2% target – while on Friday the monthly non-farm payroll report is expected to show a gain of 190k jobs.

While data can surprise in either direction, even if this week’s data comes in-line with expectations, the US dollar will continue to move forward with a rate hike at June’s FOMC fully expected. The EUR in contrast will still need to battle against the political upheaval in Italy, while Friday’s vote of no confidence in Spanish PM Rajoy will again turn the spotlight on Europe.

The daily EURUSD chart below shows that the initial target of 1.1554 was made earlier this week and a short period of consolidation may lie ahead for the pair. The upside however should remain capped at 1.17175, the December 12 swing low. The pair may pick up some strength from the RSI indicator which remains in oversold territory but is pointing higher.

The latest IG Client Sentiment Indicator shows retail however are 59.6% net-long EURUSD giving a strong bearish contrarian bias.

EURUSD Price Chart Daily Timeframe (October 2017 – May 30, 2018)

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on the EURUSD? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

— Written by Nick Cawley, Analyst