GBPUSD Analysis and News

- BoE speakers in focus for near-term GBP direction

- August rate hike seen at a 34% chance

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

BoE Speakers in Focus for GBP

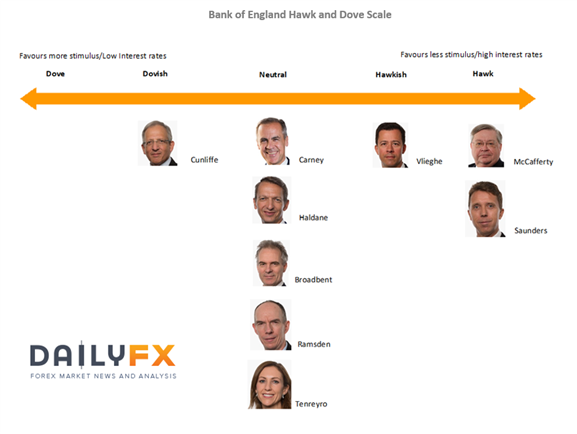

This week will see a slew of BoE speakers, beginning with Silvana Tenreyro due to speak from 1700GMT, who was among one of the 7 MPC rate setters who voted against raising rates at the May Quarterly Inflation. Two other members who voted against raising rates last month is also due to speak with Jon Cunliffe speaking tomorrow at 1000GMT and Dave Ramsden on Thursday at 1500GMT (Both also voted against raising rates in November). These upcoming speeches will be key to gauge the likelihood of an August rate hike, any suggestions raising the probability of a summer rate rise could see GBPUSD lifted. (Speaker schedule on the DailyFX calendar, click here)

Source: DailyFX (Bank of England Hawks/Doves Scale)

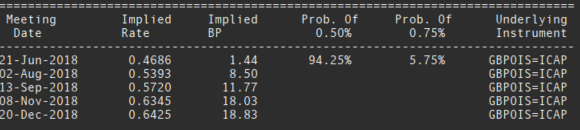

Rate Hike Probability

With June effectively written off as an opportunity for the BoE to raise rates, focus is on the August QIR meeting, whereby OIS markets are pricing in a 34% chance of a 25bps rate hike. Today’s Construction PMI alleviated concerns of a further deterioration in the UK economy with the reading above expectations at 52.5 (Exp. 52.0). Eyes on tomorrow’s Service PMI which is expected to tick up to 53 from 52.8. Incoming data and a talking up of monetary tightening by BoE members will be needed in order to raise the likelihood of a near term rate hike.

Source: Thomson Reuters

For a more in-depth analysis on Sterling, check out the Q2 Forecast for GBP/USD

GBPUSD PRICE CHART: DAILY TIME FRAME (August 2017-June 2018)

Near-term base for GBPUSD resides at 1.33, while the next target for the pair is the 1.34 handle which also coincides with the 20DMA, currently acting as resistance. Next significant upside target will be the 1.3550 area whereby the 38.2% Fibonacci Retracement of the 1.2563-1.4377 rise is situated.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX