Current Market Developments – Brexit Bill Passes, GBP Struggles Finding Direction

A day that was filled with event risk saw markets swinging as traders braced for the impending FOMC and ECB rate decisions later on. Wall Street was cautiously higher and the S&P 500 managed to keep gains, rising about 0.17%. The intraday volatility though did leave an impact on sentiment-sensitive currencies with the Australian and New Zealand Dollars down against its major counterparts. This was further compounded by a rise in the US Dollar towards the end of Tuesday’s session.

Of all the forex majors, the British Pound was arguably the most volatile given the EU withdrawal bill. Initially, Sterling rose as news crossed the wires that several conservative lawmakers said that they would vote with Theresa May’s government. Then, when the Brexit bill passed 324 to 298 and fended off the Tory rebellion, GBP/USD declined and finished the day little changed. To appease some tories for the vote, May had to offer a concession that would allow them to potentially veto the Brexit deal she secures.

A Look Ahead – AUD Awaits RBA Speech, Markets Look to Fed and ECB Next

The most prominent event risk during Wednesday’s Asia trading session is arguably a speech that will be presented from RBA’s Governor Philip Lowe. For some time now, the central bank has reiterated that their next rate move is likely to be a hike, but for the time being they are being patient to act. At this point, overnight index swaps don’t envision one until about halfway into 2019. Signs from him that it may come sooner is likely to boost the Australian Dollar and vice versa.

Given the impending monetary policy announcements from the US and European Union ahead, it won’t be too surprising to see restrained price action in FX until those critical events have passed. In addition, the weekend G7 summit and yesterday’s summit between US President Donald Trump and North Korean Leader Kim Jong-un are also now behind us. This furthers adds to the argument that we may see consolidation for the time being. However, some traders may be eager to take bets.

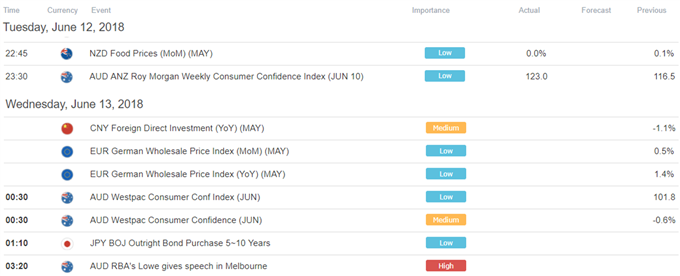

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

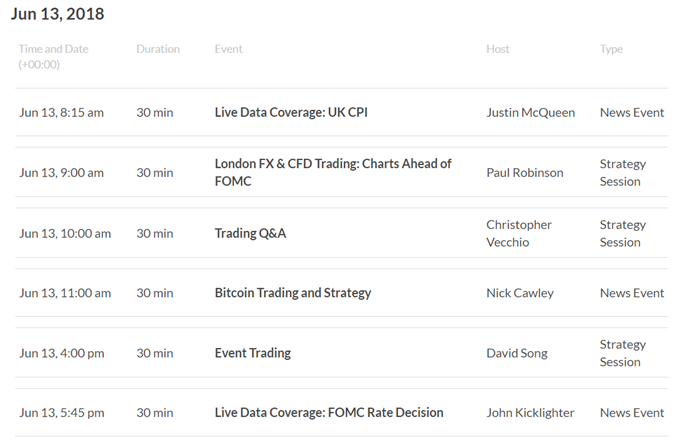

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

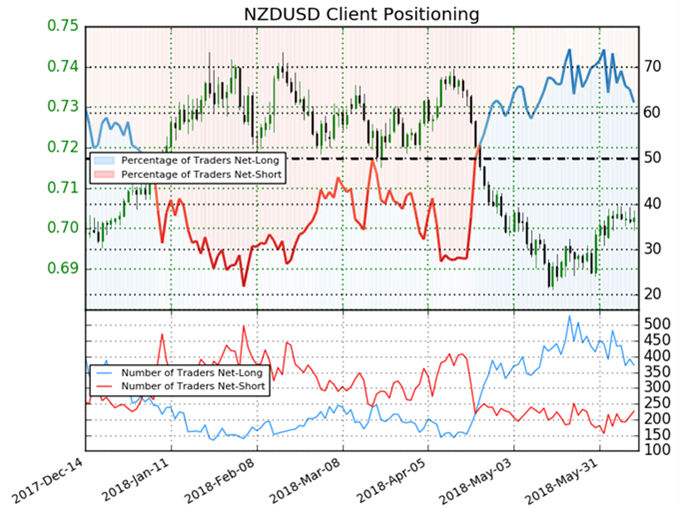

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 62.3% of NZD/USD traders are net-long with the ratio of traders long to short at 1.65 to 1. In fact, traders have remained net-long since Apr 22 when NZD/USD traded near 0.73652; price has moved 4.6% lower since then. The number of traders net-long is 6.3% lower than yesterday and 14.6% lower from last week, while the number of traders net-short is 15.3% higher than yesterday and 3.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading:

- AUD/JPY Technical Outlook: Rally Rejected at Resistance by Michael Boutros, Currency Strategist

- GBP/USD Forecast: Bearish Series Remains in Play Ahead of U.K. CPI by David Song, Currency Analyst

- US Dollar Price Action Setups Ahead of FOMC, ECB, BoJ by James Stanley, Currency Strategist

- Weekly Technical Perspective on the Euro (EUR/USD)by Michael Boutros, Currency Strategist

- USD/JPY Advance Stalls Ahead of FOMC as U.S. CPI Fails to Impress by David Song, Currency Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter