USD News and Talking Points

– US Dollar boosted by extra Fed communication chatter.

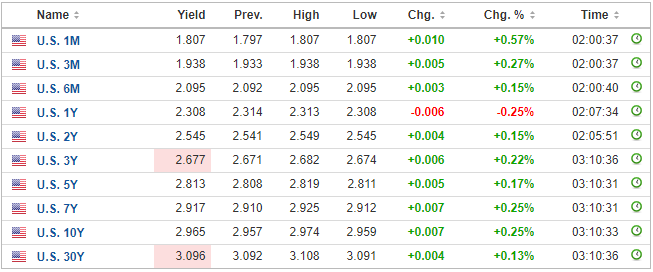

– Short-Dated US Treasury yields near recent highs.

The DailyFX Q2 Trading Forecasts for all major currencies, commodities and indices, are now availableto download to help you make more informed trading decisions.

US Dollar to be Underpinned by Rate Hike, Hawkish Chatter

The Fed is fully expected to hike interest rates by 0.25% at today’s FOMC meeting, the second hike in a year. After the rate decision Fed Chair Jerome Powell will communicate his thoughts on the US economy and likely give clues to further rate hikes ahead, with analysts divided if there will be a total of three or four 0.25% hikes in 2018. At present there are only four FOMC meetings a year that also have updated economic projections – March, June, September and December – and these meetings are the ones traditionally seen as ‘live’ where policy changes occur. The market view is that if Powell now communicates after every meeting, all eight FOMC meetings per year should be seen as ‘live’.

Today’s meeting comes on the back of some robust US economic data with yesterday’s US inflation reading the highest in six years, while US unemployment is at an 18-year low. If Powell does give himself flexibility on communication and if today’s rate hike is accompanied by a hawkish Fed chatter, the US dollar could easily rally back to recent highs.

DailyFX Chief Currency Strategist John Kicklighter will be covering the FOMC Meeting Live from 6:45pm.

The latest IG Client Sentiment Indicator shows retail are positioned in a wide range of currency pairs, commodities and indices, and why sentiment changes matter.

US Dollar Index Price Chart Four Hour Timeframe (May 10 – June 13, 2018)

US Treasury Yields Pushing Higher

With US monetary policy tightening further, US Treasury yields continue to push higher, giving strength to the greenback. The interest-rate sensitive 2-year is near its recent decade-high of 2.59% while the 10-year will hit a new seven-year high when it trades back above 3.12%.

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on the US Dollar? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

— Written by Nick Cawley, Analyst