US Market Snapshot via IG: DJIA 0.33%, Nasdaq 100 0.4%, S&P 500 0.3%

Major Headlines

- ECB Plans QE Exit, but Signals Rate Hikes are Distant

- UK Retail Sales Sees Another Sizeable Rebound

- US Retail Sales Beat Analysts Estimates

EUR: ECB surprised markets by announcing decision to reduce the pace of QE purchases after September 2018 by EUR 15bln until the end of December 2018, by which net purchase will come to an end. However, the Euro plunged following its rate path guidance, whereby the council judged that current rates will remain at current levels at least until Summer of 2019. Consequently, money markets have repriced a 10bps rate hike for September 2019.

GBP: Another sizeable rebound in UK retail sales for May, which saw all metrics printed ahead of expectations, subsequently, this took GBP too session highs against its major counterparts. The headline monthly reading surged 1.3% (Exp. 0.5%), while there was also an increase in the core reading of 1.3% (Exp. 0.3%). The ONS stated that the bounce in retail sales was due to good weather, alongside the royal wedding celebrations resulting in a boost on food and household goods. However, the gains in the Pound had been hampered following the rise in the USD, which had been led by EUR selling post ECB. GBPUSD now toying with the 1.33 handle.

USD: The greenback outperforms, largely as a by-product of the sell-off in the Euro, as such, the USD is back above 94.00. Another factor supporting the USD has been the better than expected retail sales and jobless claims data.

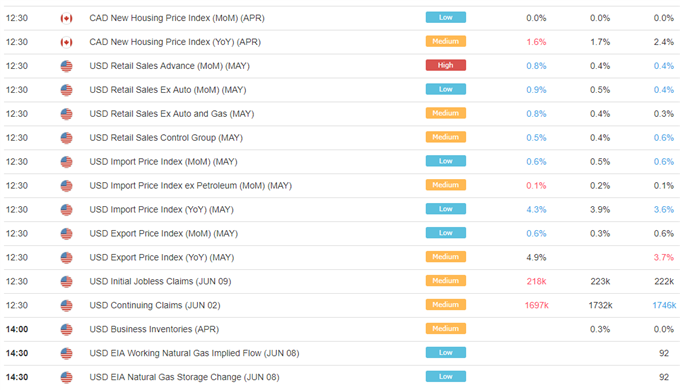

DailyFX Economic Calendar: Thursday, June 14, 2018 – North American Releases

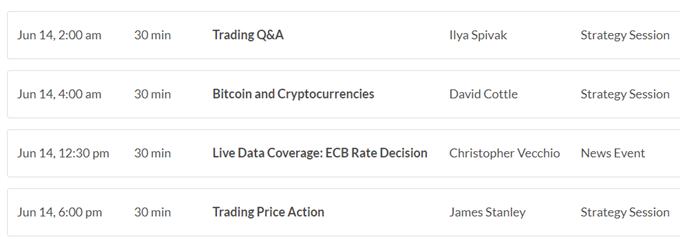

DailyWebinar Calendar: Thursday, June 14, 2018

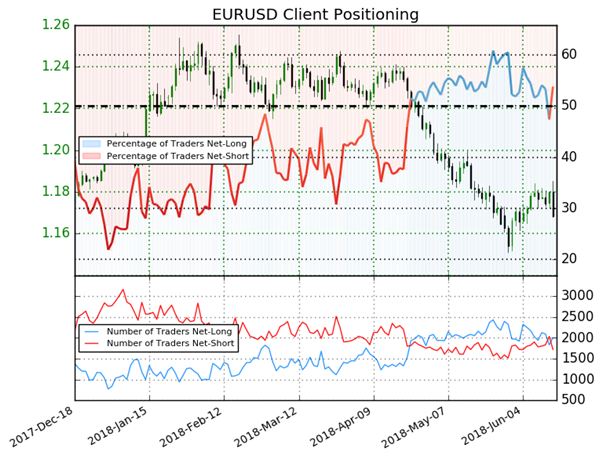

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 53.8% of traders are net-long with the ratio of traders long to short at 1.16 to 1. The number of traders net-long is 5.7% lower than yesterday and 8.7% lower from last week, while the number of traders net-short is 16.6% lower than yesterday and 7.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “ECB Announces QE Taper, However, EUR Falls on Rate Path Guidance” by Justin McQueen, Market Analyst

- “EURUSD May Fall Sharply in the Months Ahead” by Nick Cawley, Market Analyst

- “GBPUSD Rises as Royal Wedding Celebrations Lifts Retail Sales”by Justin McQueen, Market Analyst

- “Technical Outlook – EURGBP Battling Confluence of Resistance”by Nick Cawley, Market Analyst

- “EURUSD May Fall as ECB Disappoints the Euro Bulls” by Martin Essex, MSTA , Analyst and Editor

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX