Current Developments – Trade War Fears Send Wall Street Gapping Lower

Increasing trade war concerns took their toll on US equities as the week began with gaps lower in the S&P 500 and Dow Jones Industrial Average. While stocks there managed a slight pullback throughout the session, they ended lower 0.21% and 0.41% respectively. Not surprisingly, the sentiment-linked Australian and New Zealand Dollars were some of the worst performing FX majors.

A rising US Dollar towards the end of Monday’s session kept the Aussie and Kiwi subdued, but the greenback finished little changed thanks to earlier declines. Not surprisingly, the anti-risk Japanese Yen and Swiss Franc were some of the best performing majors.

The British Pound struggled to find direction ahead of a BOE rate decision when the House of Lords voted 354 to 235 to give parliament a meaningful vote. This allows it a greater say in the event the government does not provide a Brexit deal by February. Now the vote goes on to the House of Commons on Wednesday.

A Look Ahead – RBA Minutes May Pass Without Volatility, FX Eye Risk Trends

The Australian Dollar will look to the RBA June meeting minutes. Since this month’s monetary policy announcement, Governor Philip Lowe spoke and said that a hike is ‘some time away’. As such, the details may not add more to what is already known.

With that in mind, risk trends will probably be the main driver for FX markets yet again as traders look for updates on the global trading environment. If you would like to learn more about the background on this, check out our infographic covering the brief history of trade wars since 1900.

Prior Session Recap – Crude Oil Prices Rise, CAD Does Not

Crude oil prices recovered on reports from OPEC that the anticipated production boost will be less than expected. This crossed the wires ahead of this week’s cartel gathering. The Canadian Dollar was unable to capitalize on the update though, likely held down by US Dollar gains towards the end of Monday’s session.

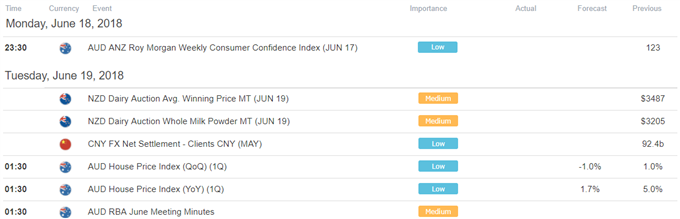

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

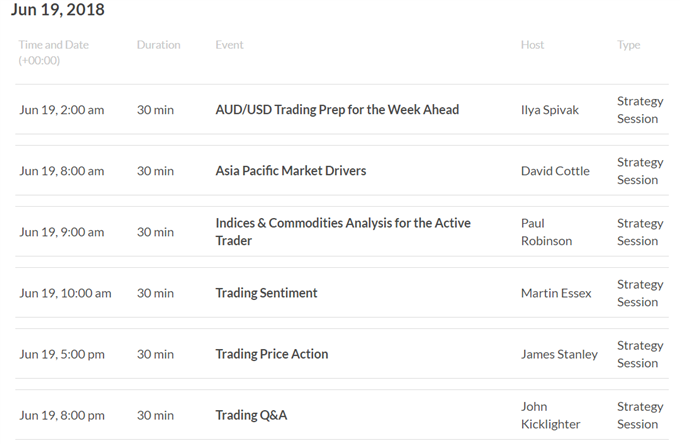

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

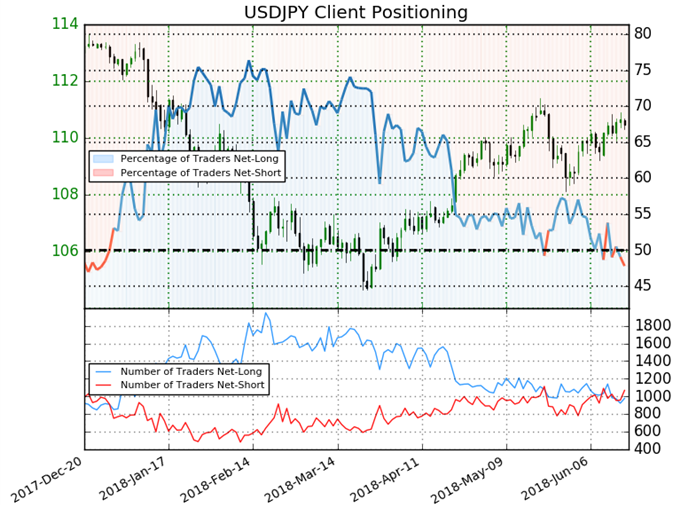

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 47.8% of USD/JPY traders are net-long with the ratio of traders short to long at 1.09 to 1. The number of traders net-long is 1.4% higher than yesterday and 6.0% lower from last week, while the number of traders net-short is 7.2% higher than yesterday and 4.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

Five Things Traders are Reading:

- GBP/USD: Cable Attempts to Carve Out Support Ahead of BoE by James Stanley, Currency Strategist

- Bitcoin May Reverse Higher Based on Sentiment by Abdullah AI Amoudi, DailyFX Team

- Weekly Technical Perspective on the US Dollar (DXY)by Michael Boutros, Currency Strategist

- US Dollar Strength, Euro Weakness Remain as Risk Aversion Shows Up by James Stanley, Currency Strategist

- Australian Dollar Faces Calmer Week, But That May Not Save Itby David Cottle, Analyst

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter