GBPUSD Prices, News and Analysis

- Fibonacci retracement may support GBPUSD in the short-term.

- Brexit risks remain as EU Withdrawal Bill vote nears.

- US dollar probing fresh multi-month highs.

IG Client Sentiment data show that retail traders are long of GBPUSD and have remained long of the pair since April 20 when GBPUSD traded around 1.42300.

GBPUSD – Fundamentals and Technicals

GBPUSD continues to probe the downside on a combination of renewed US dollar strength – despite the escalation of the US-China trade dispute – and a continued Brexit stalemate. This combination has seen the pair drop 12 big figures from the 1.43768 high made just over two months ago. Brexit talks will be in the spotlight today as the House of Commons votes on amendments made to the EU Withdrawal bill with the outcome balanced. A defeat for the UK government, while not terminal, will weaken their bargaining position with the EU as trade talks approach.

US Dollar Basket Touching Multi-Month Highs

GBPUSD and the Likely Path Lower

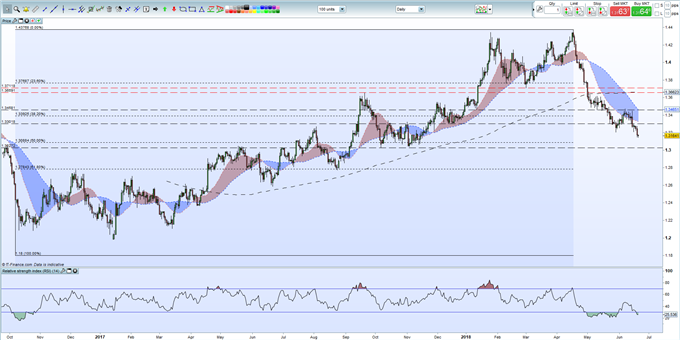

The daily chart shows that the pair are approaching a couple of important support levels, which if broken could see GBPUSD drop below 1.28000. The 50% Fibonacci retracement of the 1.1800 – 1.43768 rally is set at 1.30884 and may provide early support for the pair ahead of the October 5 low at 1.30272. If neither of these levels hold, a fall back to the 61.8% Fibonacci retracement level at 1.27843 becomes more likely. GBPUSD remains negative, trading below all three moving averages, but the RSI indicator is now in oversold territory and may provide short-term support. There is a strong resistance on the upside between 1.33018 and 1.34581 which would need a fundamental shift in sentiment before GBPUSD trades higher.

GBPUSD Daily Price Chart (October 2017 – June 20, 2018)

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of Educational and Trading Guides

— Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1