US Market Snapshot via IG: DJIA 0.4%, Nasdaq 100 0.25%, S&P 500 0.25%

Major Headlines

- ECB fret over looming trade war – sources

- OPEC remain confident that an agreement will be reached, despite Iranian defiance

CAD: Widening interest rate differentials between US and Canadian bond spreads continue to weigh on the Canadian Dollar, which hovers around the 1.33 handle against the greenback as BoC rate hike expectations continue to recede (66% priced in for a 25bps in July). Risk of escalating trade spat continues to keep CAD offered.

GBP:Focus on the meaningful vote in the House of Commons today, reports this morning suggested that Tory rebels will support the government, meaning that PM May would avoid defeat, while Brexit Minister Davis ally believes that the government can will Brexit vote today. As such, GBP has recovered from the lows, briefly printing above 1.32. Vote to take place from 1330GMT.

EUR: A flurry of comments from ECB members with, most notably from Nowotny who stated that risks for financial stability are political and also sees the Euro depreciating against the USD. As such, EURUSD has failed to make a break above 1.16, while source reports from the ECB, voiced concerns over looming trade war, which could complicate the ECB’s stimulus exit.

Crude Oil: Brent and WTI crude futures firmer this morning, following the latest API crude inventory report which showed a wider than expected drawdown of 3mln bpd. Elsewhere, Libya stated that production lost following recent conflict has amounted to 450k bpd. Focus on Friday’s OPEC meeting, where most oil ministers expected to reach a consensus for boosting oil production, despite Iran’s defiant stance.

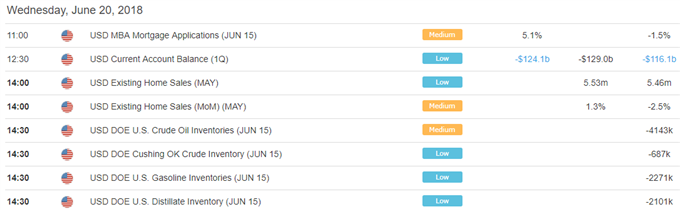

DailyFX Economic Calendar: Wednesday, June 20, 2018 – North American Releases

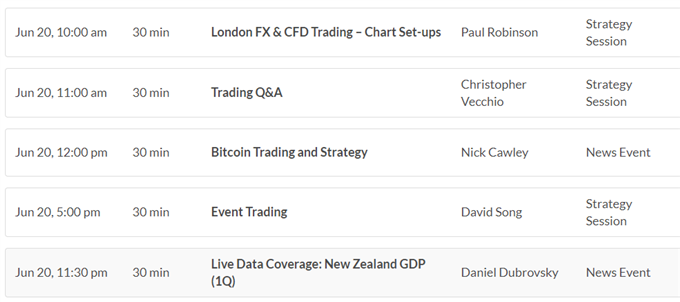

DailyWebinar Calendar: Wednesday, June 20, 2018

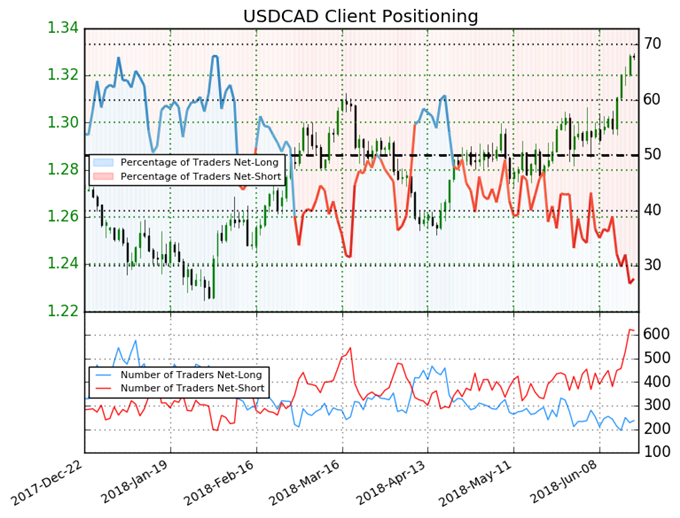

IG Client Sentiment Index: USDCAD Chart of the Day

USDCAD: Data shows 27.7% of traders are net-long with the ratio of traders short to long at 2.61 to 1. In fact, traders have remained net-short since May 22 when USDCAD traded near 1.28776; price has moved 3.1% higher since then. The number of traders net-long is 2.6% higher than yesterday and 6.7% lower from last week, while the number of traders net-short is 1.6% lower than yesterday and 39.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias

Five Things Traders are Reading

- “DXY Index, EUR/USD Inside Day Candlesticks Take Shape” byChristopher Vecchio, CFA, Sr. Currency Strategist

- “Cryptocurrency Webinar: The Calm Before the Storm?” by Nick Cawley, Market Analyst

- “Chart Outlook– USD Index, GBP/USD, USD/JPY, Gold Price & More”by Paul Robinson, Market Analyst

- “BoE Interest Rate Decision: Mixed Data to Prompt Wait and See Approach”by Justin McQueen, Market Analyst

- “Gold Price Analysis: Risk Aversion May Slow Recent Collapse” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX