GBPUSD Analysis and News

- Sterling Falls as Incoming BoE Haskel leans to Dovish Spectrum

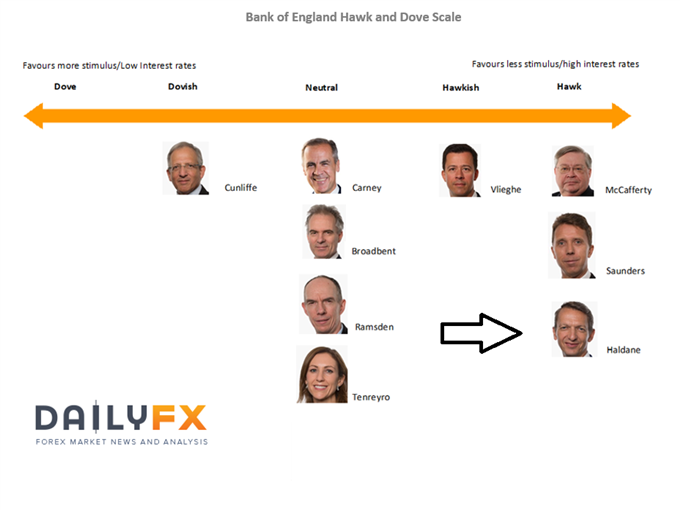

- Focus on Carney and Recent Hawkish Dissenter Haldane

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

GBP Falls as Incoming Dove is Set Replace Outgoing Hawk

Today, markets were given a first glimpse of the bias of incoming Bank of England rate setter Jonathan Haskel, who will replace one of the most hawkish members on the committee, Ian McCafferty, when his term expires in August. One thing that was made apparent is the wide difference in views with Haskel leaning on the dovish side, having stated that there may be more slack in the economy, weakening the case for an interest rate rise. This was in stark contrast to McCafferty who stated that the BoE should not dally in raising rates. As such, with greater focus on the incoming rate setter, GBPUSD fell to its lows of the days, falling from 1.3276 from 1.3206. The question is, will the recent 6-3 vote split, revert back to 7-2 when hawkish dissenter, McCafferty is replaced?

Eyes on Carney and Haldane for GBP Direction

GBP traders will be keeping a close eye on comments from BoE Governor Carney who is scheduled to speak at the financial stability report from 830GMT. Additionally, BoE Chief Economist Haldane is also set to speak on Thursday from 1330GMT which will likely take greater precedence, given that the rate setter surprised many by voting for a hike at the most recent MPC meeting, subsequently pushing up rate hike expectations for the BoE with an August rate hike seen at 53%.

Source: DailyFX (BoE Hawk/Dove scale, updated following June MPC meeting)

GBP/USD PRICE CHART: 1-MINUTE TIME FRAME (Intra-day)

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX