US Market Snapshot via IG: DJIA -0.3%, Nasdaq 100 -0.1%, S&P 500 -0.1%

Major Headlines

- German Inflation 2.1% vs. Exp. 2.1% (Prev. 2.2%)

- US Q1 Final GDP reading misses expectations at 2%

- RBNZ Remains Dovish, BoC Governor Provides Mixed Messages for July Rate Decision

USD: Yet again the USD has rejected a firm move above 95.50, which has seen the greenback push back towards support at 95.05-15. Reminder month-end rebalancing could play a key role in USD selling over the next two days as indicated by investment bank models. Additionally, final GDP data for Q1 from the US fell below expectations at 2% (Exp. 2.2%), subsequently leading to a further retracement of earlier gains.

EUR: The Euro slightly firmer as option related buying above 1.15 barrier options continue to support EURUSD, despite German inflation easing slightly with the headline rate falling 0.1ppt to 2.1%. Typical month-end buying sees EURGBP break above 0.8840, however, a close above could see the cross on course for the 0.8900 handle.

GBP: Among the worst performing currencies today as Sterling faces a couple potentially tricky days ahead with Brexit on the menu at the EU Summit. No resolution is expected but a further round of negative talk from the EU will increase fears of a no-deal Brexit which neither side really wants. Focus for GBPUSD is 1.3025-1.3030, which coincides with the October 2017 low and rising GBP flash crash trendline support.

CAD: BoC Governor Poloz provides mixed signals over a July rate hike with the governor fretting over the effects of US tariffs and tighter mortgage rules, however, noted that the economy is at a situation where it will warrant higher interest rates. Initially, USDCAD had been somewhat undecisive, although grinded lower as rate hikes bets for July increased, which sits at 63% from 54%.

NZD: Overnight, the RBNZ announced its latest monetary policy decision, in which the central bank had been had kept the Official Cash Rate at 1.75%, while also providing a more dovish report than previously, which in turn has led to a fresh wave of NZD selling. The central bank signalled yet again that the next move in rates could be up or down, as such, this highlights the fact that the RBNZ are a long way from considering raising rates with only the end of 2019 seen as a possibility. Subsequently, this prompted NZDUSD to break through the November 2017 low (0.6780).

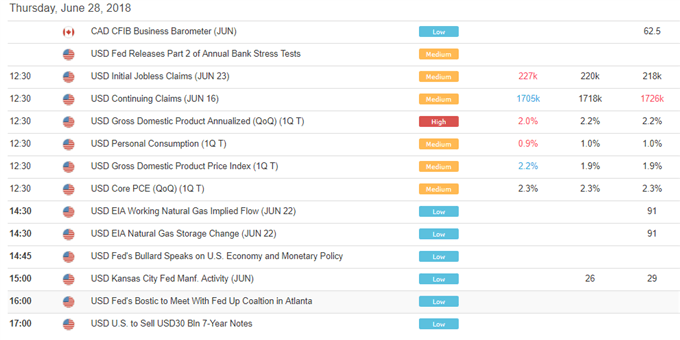

DailyFX Economic Calendar: Thursday, June 28, 2018 – North American Releases

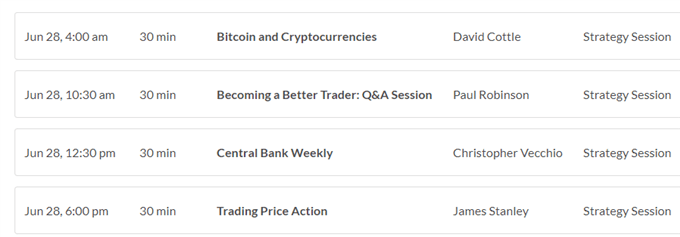

DailyWebinar Calendar: Thursday, June 28, 2018

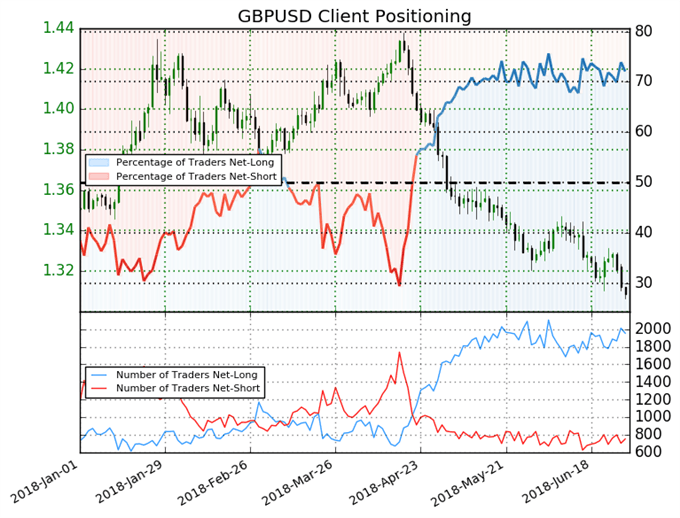

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 72.1% of traders are net-long with the ratio of traders long to short at 2.58 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.41803; price has moved 7.7% lower since then. The number of traders net-long is 2.5% higher than yesterday and 0.6% higher from last week, while the number of traders net-short is 6.5% lower than yesterday and 1.9% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

Five Things Traders are Reading

- “DXY Index Back to Yearly High; Beware Month-End Rebalancing” byChristopher Vecchio, CFA, Sr. Currency Strategist

- “Dow Drops to Fresh Seven-Week Lows, Approaches Key Chart Support” by James Stanley, Currency Strategist

- “NZDJPY Selling Attractive on Dovish RBNZ and Trade Wars”by Justin McQueen, Market Analyst

- “US Crude Oil Price Hits 3½-Year High, More Gains Expected”by Martin Essex, MSTA , Analyst and Editor

- “EURUSD Price at Risk of Further Heavy Fall” by Martin Essex, MSTA, Analyst and Editor

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX