Japanese Yen Talking Points:

- The Japanese Yen was uninspired by lowest jobless rate since 1992 at 2.2% vs. 2.5%

- Low CPI makes another solid employment beat rather irrelevant for BoJ policy bets

- USD/JPY is testing uptrend resumption, risk trends to drive Nikkei 225 and thus Yen

Just started trading USD/JPY? Check out our beginners’ FX markets guide!

As anticipated, the lowest unemployment rate since 1992 did little to offer bullish momentum to the Japanese Yen. In May, Japan’s jobless rate further contracted to 2.2 percent unexpectedly. Economists were anticipating a hold of 2.5%. The job-to-applicant ratio also beat estimates coming in at 1.60 versus 1.59 while the labor force participation rate remained unchanged at 61.7%.

Not too long ago, Japan’s Finance Minister highlighted that there was a labor shortage in the country. As such, you would expect prices to rise in the country as employers outbid each other for the few remaining prospective candidates. But significant wage growth has been absent and the country is notoriously known for its lack of inflation.

As such, it is not too surprising to see such minimal reaction from the Japanese Yen as this data has very limited implications for changing Bank of Japan monetary policy prospects. The central bank is showing no signs of halting its quantitative easing programme as it downgraded its assessment of inflation at their most recent rate announcement.

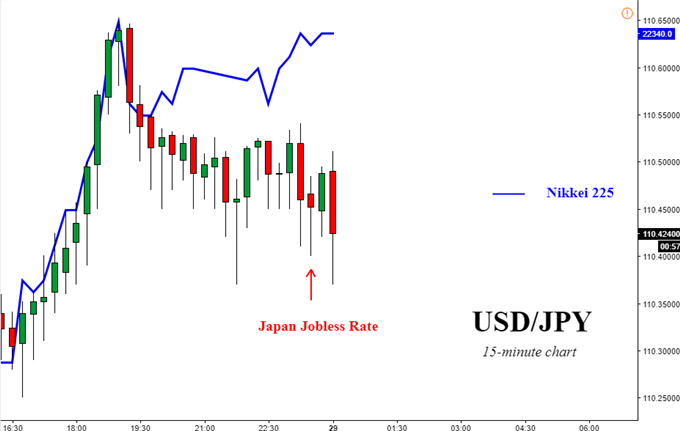

With that in mind, the anti-risk Japanese Yen has been more interested in risk trends lately. Looking at the immediate chart below, you can see the unit depreciating against the US Dollar as Nikkei 225 futures rose during the US trading session. As such, updates from the two largest economies on trade developments are likely to influence sentiment in the near-term, thus impacting the perennially haven Yen.

BACKGROUND: A Brief History of Trade Wars, 1900-Present

USD/JPY 15-Minute Chart: Japan Jobless Rate Reaction

Chart created in TradingView

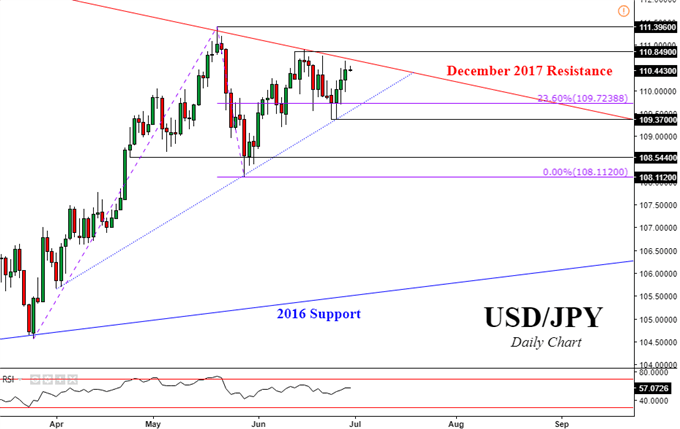

USD/JPY Technical Analysis: On the Edge of Uptrend Resumption?

On a daily chart, USD/JPY has still been struggling to make progress above the long-term descending trend line from 2017. Nevertheless, a break above it opens the door for resuming its uptrend since April. However, it will then have to climb above the highs set earlier this month around 110.84. A push above that exposes the May high at 111.39. On the other hand, immediate support is the 23.6% Fibonacci retracement at 109.72.

Chart created in TradingView

USD/JPY Trading Resources:

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- See our free guide to learn what are the long-term forces driving Japanese Yen prices

- See how the Japanese Yen is viewed by the trading community at the DailyFX Sentiment Page

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter