GBPUSD Analysis and News

- UK Manufacturing PMI beats expectations, providing a boost for BoE hawks.

- Initial Sterling gains short-lived amid the risk averse environment

Check out our new Fundamental and Technical Q3 forecast guide for GBPUSD

UK Manufacturing Output Remains Subdued

UK Manufacturing PMI remained subdued at the end of the quarter, showing a rise of 54.4 in June, above expectations of 54. However, there had been a slight revision to 54.3 from 54.4 for the prior months reading. In reaction to the report, GBPUSD saw a 10-pip uptick, although the initial gains had been short lived with the pair back at pre-announced levels. IHS Markit stated that output growth had slowed from the five months high reached in May, while input cot inflation picked up, leading to increased selling prices, which in turn saw optimism falling to its lowest level this year.

Bank of England Rate Outlook

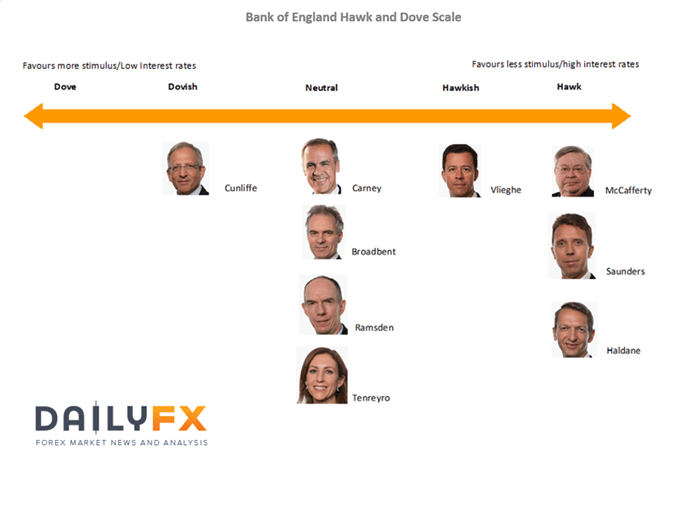

The better than expected Manufacturing PMI will provide additional ammo for the hawkish members on the committee. As it stands, OIS markets are pricing in a 60 probability of an August rate hike, while 22bps worth of tightening is priced in by November. The increased likelihood had stemmed from the most recent monetary policy decision in which BoE Chief Economist dissented and called for a 25bps rate hike, providing a 6-3 vote split. Over the weekend, BoE Deputy Governor Jon Cunliffe had warned that escalating trade wars, strains in emerging markets and a rising possibility of a Chinese credit crisis could provide a painful experience for the UK economy. As a reminder, Cunliffe is one of the more dovish members.

Source: DailyFX (Bank of England Hawk/Dove Scale)

GBPUSD PRICE CHART: 1-MINUTE TIME FRAME (INTRADAY July 2, 2018)

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX