GBPUSD Analysis and News

- UK Services Rises to Best Level Since October, BoE Rate Hike Bets Boosted

- PMI Surveys Indicate UK Q2 GDP at 0.4%

- Check out the brand new Q3 Forecast for GBP/USD

Q2 Rebound as Suggested by PMI Surveys

The Pound saw an uptick against the US Dollar following today’s UK Services PMI report, which rose to its highest level since October at 55.1, above expectations of 54. As such, this rounds off a week of firm data points, in which both the Manufacturing and Construction PMI surveys also beat forecasts. All in all this suggests that the UK growth will likely show a rebound in the second quarter with IHS Markit stating that survey data indicates that GDP likely grew 0.4%, up from 0.2% in Q1.

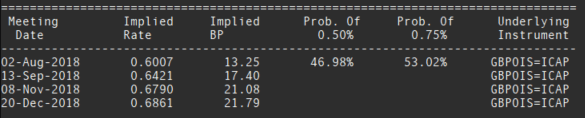

The better than expected Services PMI report will likely provide ammo for the hawkish members on the BoE committee (last rate decision saw a 6-3 vote split), while BoE rate hike expectations were lifted in response to the data, whereby odds of an August rate hike are at 53% from 49%. In turn, this will likely maintain the recent positive momentum for GBP.

Bank of England to Hike in August Seen as Most Likely Scenario

Source: Thomson Reuters (BoE Rate Hike Expectations)

GBPUSD PRICE CHART: 1-MINUTE TIME FRAME (intra-day)

See how retail traders are positioning in GBPUSD as well as other major FX pairs on an intraday basis using the DailyFX speculative positioning data on the sentiment page.

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX