Crude Oil & Gold Talking Points:

- Gold prices pared gains as USD rose amidst GBP weakness on Brexit news

- Crude oil prices are running out of upside momentum, hinting at losses next

- Near-term resistance at 1,258 seems to be keeping gold at bay, can it hold?

Find out what retail traders’ gold buy and sell decisions say about the coming price trend!

Gold prices finished Monday’s session little changed as the US Dollar experienced a similar behavior. During the second half of the day, aggressive declines in the British Pound on Brexit uncertainty as UK Foreign Secretary Boris Johnson resigned and lower BoE rate hike bets offered a boost to the greenback. Thus, the anti-fiat yellow metal quickly found itself paring gains from the first half of the day.

Crude oil prices also traded mostly sideways on Monday as the commodity awaits a couple of key events later on this week. U.A.E. Energy Minister Suhail Al Mazrouei mentioned today that OPEC has enough capacity to offset output shortfalls. Last week, the commodity struggled finding more upside momentum as US President Donald Trump critiqued inflated oil prices after pressuring the Saudis to boost production.

From here, a lack of key US economic data will have the greenback focusing on the external front. More Brexit uncertainty and lower BoE rate hike bets can boost it, adding downside pressure to the yellow metal. Gold may also respond to German and Eurozone sentiment reports depending on how the Euro interacts with the USD. The downside risk here is if 2019 ECB rate hike bets get pushed out further, making the greenback more attractive.

Crude prices on the other hand will look to API estimates of weekly US oil inventories. Official EIA projections are calling for a 3.9m contraction later this week. A higher-than-anticipated reduction may revive upside momentum in the commodity and vice versa. However, continued uncertainty around supply disruptions amidst US sanctions on Iranian oil exports could undermine a lasting response to the API estimates.

Gold Technical Analysis

Gold prices have bounced higher after failing to push below the December 2017 low around 1,236, forming a channel of support. Heading into the recent push higher, positive RSI divergence warned that downside momentum was ebbing. Since then, near-term resistance appears to have formed around the 61.8% Fibonacci extension at 1,258. A daily close above this area exposes the 50% midpoint at 1,267.

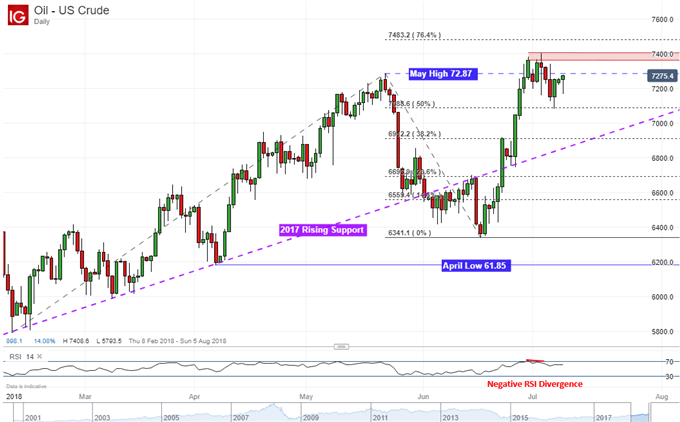

Crude Oil Technical Analysis

Crude oil prices are struggling to regain upside momentum after pushing above the May high at 72.87 as indicated by negative RSI divergence. This suggests that the commodity may turn lower in the near-term but a reversal would need some confirmation first. From here, immediate support is at 70.88 or the 50% midpoint of the Fibonacci retracement. A break below exposes the 38.2% extension at 69.12.

Commodity Trading Resources:

- See our free guide to learn what are the long-term forces driving crude oil and gold prices

- Just getting started? See our beginners’ guide for FX traders

- Join a free Q&A webinar and have your trading questions answered

— Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter