GBPUSD Analysis and News

- UK GDP shows growth continues to pick

- Brexit Uncertainty amid political disarray weighs on Sterling

For a more in-depth analysis on Sterling, check out the Q3 Forecast for GBP/USD

UK Economy Picks up After Q1 Slowdown

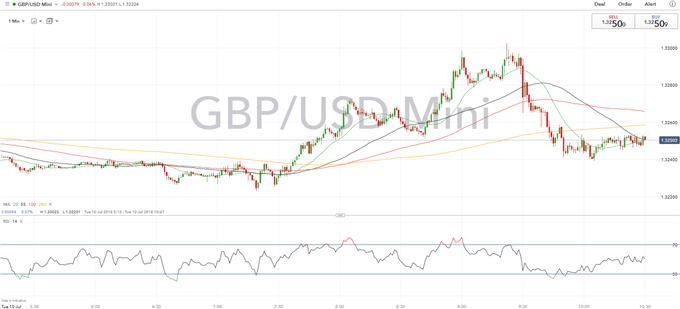

The UK economy continued to pick up in May after the slowdown seen in Q1 amid the boost in service sector growth, while manufacturing and industrial activity data disappointed. Today saw the release of a new monthly reading for GDP, which will be looked at closely by the BoE as they decide on whether to raise the bank rate at next month’s policy meeting. ONS showed that the UK grew in line with expectations at 0.3% in May, marking a yearly reading of 1.5%, above consensus for 1.4%. However, despite the focus on the new GDP estimate, it was the weak manufacturing and industrial output data that prompted the selling in the Pound from 1.3295 to 1.3265 in an immediate reaction.

Economic Data Gives BoE Confidence to Raise Rates

Overall, the data suggests growth should pick up to 0.4%, as indicated by last week’s PMI data, which in turn implies that the weakness in Q1 had been temporary. Subsequently, this should give the Bank of England confidence to raise interest rates at August’s QIR.

Political Uncertainty is Biggest Catalyst for Sterling

As evidenced by yesterday’s price action, political uncertainty continues to be the biggest driver for the Pound in the short term. The resignation of Foreign Minister Boris Johnson led to a pullback in rate hike expectations for the BoE from 69% to 62% with a risk a no deal Brexit scenario increasingly likely, which is somewhat worrisome for the Bank of England who have based forecasts on a smooth Brexit transition. As such, any escalation of domestic politics involving a potential leadership contest for PM May could be enough to derail the BoE’s monetary policy path.

GBPUSD PRICE CHART: 1-MINUTE TIME FRAME (INTRADAY July 10, 2018)

GBP Analysis

IG Client Positioning shows that the fact traders are net-long suggests GBPUSD prices may continue to fall, find out more here

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

https://www.dailyfx.com/free_guide-tg.html?ref-author=McQueen