US Market Snapshot via IG: DJIA 0.8 %, Nasdaq 100 0.8%, S&P 500 0.7%

Major Headlines

- US President Donald Trump announced new tariffs on $200 billion worth of Chinese goods

- ECB divided on timing of first rate hike – sources

- US PPI rises at the fastest pace in since 2011

For a more in-depth analysis on FX, check out the brand new Q3 Forecast

Global Equities: The US-China trade war escalated overnight when US President Donald Trump announced new tariffs on $200 billion worth of Chinese goods, in a move that is expected to provoke a response from Beijing. The list of tariffs, announced after the US stock market had closed rattled investors and sent Asian and European bourses lower.

AUD: The worst performing G10 currency after the Trump administration announced another round of tariffs on China, worth $200bln. Given that China is likely to retaliate and due to Australia’s reliance on the Chinese economy, the currency is notably weaker, as such, eyes now on the 2018 low at 0.7310.

EUR: Much of the weakness in the European morning has been erased after ECB sources report, in which rate setters were somewhat divided over the timing of the first-rate hike. Dovish members see a rate hike in Autumn, while hawkish see scope for a rate hike as early as July. Subsequently, the Euro is trading back at around 1.1750, while rate hike expectations have pushed higher.

CAD: At 1400GMT focus will be on the Bank of Canada rate decision (Preview). Expectations are for the BoC to raise the bank rate to 1.50% from 1.25%, however, given that this is largely priced in, the risk is to the downside for the Canadian Dollar on a potential dovish hike amid the current trade war environment.

Crude Oil: Prices have taken a hit from the risk off environment. Brent crude futures have seen a larger decline relative to WTI given that Libya have announced that the NOC is to resume control of Eastern oil ports, subsequently, bringing back production that had been offline. While yesterday’s larger than expected drawdown in API crude inventories has alleviated some of the selling pressure.

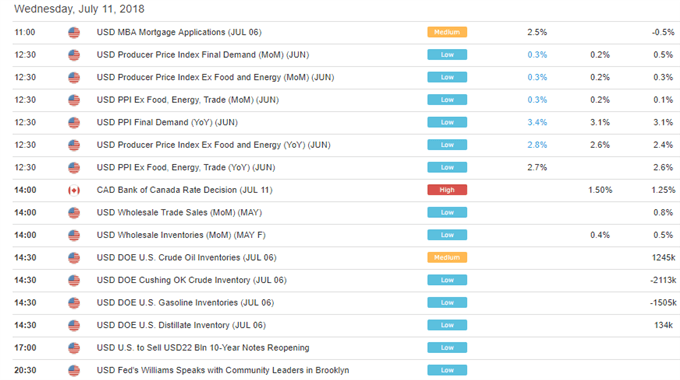

DailyFX Economic Calendar: Wednesday, July 11, 2018 – North American Releases

DailyWebinar Calendar: Wednesday, July 11, 2018

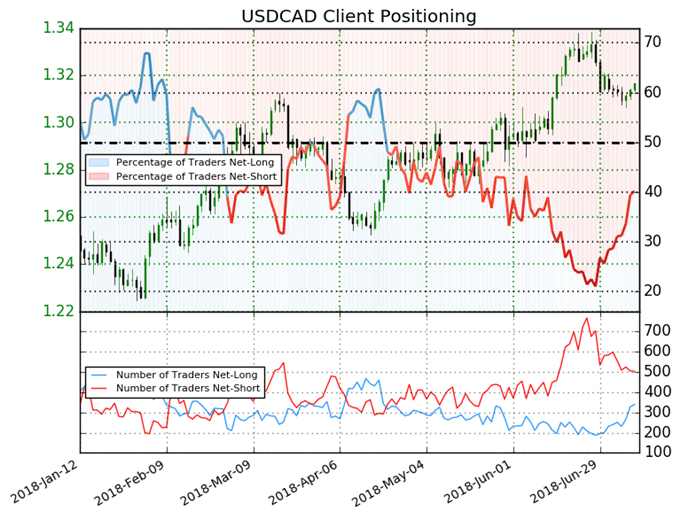

IG Client Sentiment: USDCAD Chart of the Day

USDCAD: Retail trader data shows 40.2% of traders are net-long with the ratio of traders short to long at 1.49 to 1. In fact, traders have remained net-short since May 22 when USDCAD traded near 1.27805; price has moved 3.0% higher since then. The number of traders net-long is 17.3% higher than yesterday and 57.7% higher from last week, while the number of traders net-short is 3.6% lower than yesterday and 17.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- “Trading Outlook for EUR/USD, USD/JPY, CHF/JPY, Gold Price, DAX & More” by Paul Robinson, Market Analyst

- “Gold & Silver Technical Forecast – Looking for Larger Rebound to Unfold” by Paul Robinson, Market Analyst

- “GBPUSD In Focus Ahead of Keynote Speech by Carney”by Martin Essex, MSTA, Analyst and Editor

- “AUDUSD Bears Eye 2018 Lows Amid Escalating US-China Trade War”by Justin McQueen, Market Analyst

- “Gold Price Analysis: Support Must Hold to Prime Further Gains” by Nick Cawley, Market Analyst

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.comFollow Justin on Twitter @JMcQueenFX