Check out the brand new DailyFX trading forecasts for Q3

MARKET DEVELOPMENTS – GBP FALLS AS TRUMP CRITISES PM MAYS BREXIT PLAN

At the last earning season, US corporate results had reached its best level in over 7 years with earnings growth of 24.8% and revenue gain of 8.7%. This trend is set to continue for this earning season with S&P 500 earnings growth expected to be above 20% again, given the backdrop of strong economic growth in the US and a boost from the Trump administrations tax overhaul continuing to support US corporate names and boost confidence. As such, if indeed US corporate results exceed expectations this could provide a nice distraction for equity traders and continue to buoy major equity markets.

GBP: The Pound had taken a hit after more negative headlines surrounding PM May’s Brexit strategy in which reports noted that President Trump had warned PM May that a soft Brexit proposal will kill prospects of a trade deal between the US and UK. This subsequently, pushed GBPUSD back towards 1.31 after losses had been exacerbated after a breach through 1.3175. Elsewhere, comments from the usually dovish BoE member Cunliffe had provided support for the Pound, having delivered a speech that was somewhat leaning on the hawkish side, subsequently boosting hopes that the BoE will deliver a rate hike next month.

USD: The Dollar index is moving back towards familiar technical resistance, suggesting that further gains could be limited with notable resistance potentially capping price action yet again. Focus continues to remain on the latest developments on US-China trade spat, which has quietened down since Tuesday.

NZD: The Kiwi is partially weaker on the higher greenback, edged even more so cautiously lower when local business manufacturing PMI underwhelmed. In New Zealand, that reading fell to 52.8 in June from 54.4 in May. That was the weakest reading since December 2017, making it a new 2018 low.

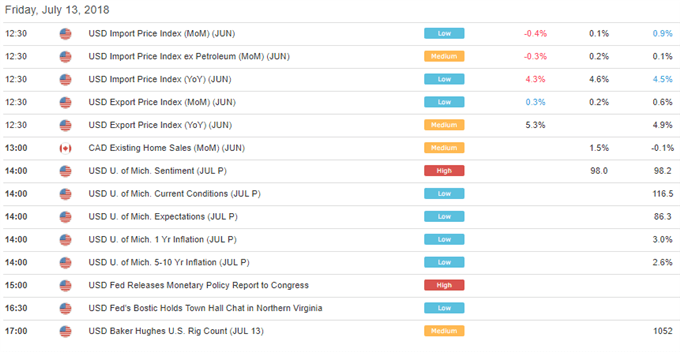

DailyFX Economic Calendar: Friday, July 13, 2018 – North American Releases

DailyWebinar Calendar: Friday, July 13, 2018

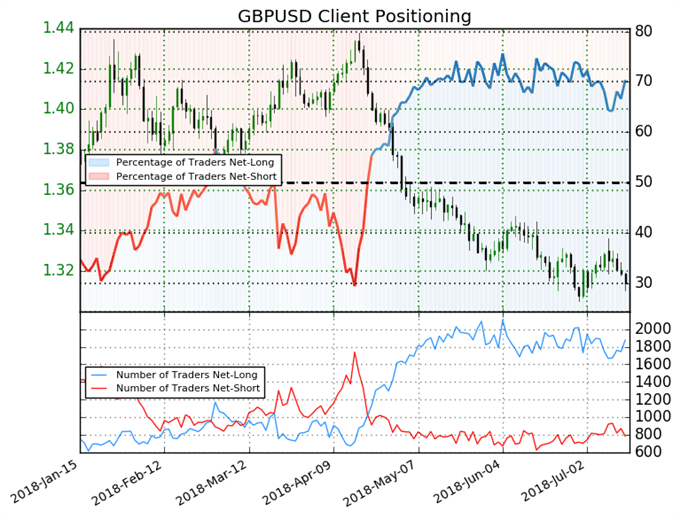

IG Client Sentiment: GBPUSD Chart of the Day

GBPUSD: Retail trader data shows 70.4% of traders are net-long with the ratio of traders long to short at 2.38 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.40897; price has moved 6.7% lower since then. The percentage of traders net-long is now its highest since Jul 05 when GBPUSD traded near 1.32203. The number of traders net-long is 3.4% higher than yesterday and 2.4% lower from last week, while the number of traders net-short is 6.1% lower than yesterday and 4.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

Five Things Traders are Reading

- “DXY Index Pacing for Gains Everyday this Week” by Christopher Vecchio, CFA, Sr. Currency Strategist

- “USD Technical Analysis: DXY at Familiar Resistance Yet Again, will it Hold?” by Justin McQueen, Market Analyst

- “Charts for Next Week: EUR/USD, Euro-crosses, USD/JPY, Gold Price & More”by Paul Robinson, Market Analyst

- “Trade War Risk to be Offset by US Q2 Earning Season”by Justin McQueen, Market Analyst

- “GBPUSD Update: Sterling Hammered by Trump on Brexit” by Nick Cawley

— Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX