EUR/USD was heading to settle above the opening level on Friday after volatile moves caused by nonfarm payrolls. The US employment report was rather mixed, making the currency pair rally after the release, drop back afterwards only to rebound almost immediately. Over the week, the currency pair was still end with losses.

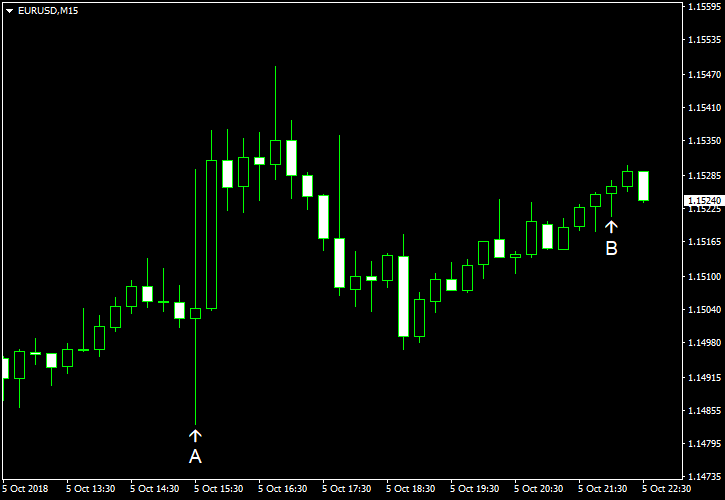

Nonfarm payrolls rose by 134k in September, far slower than markets had anticipated — 185k. Meanwhile, the August already solid reading got a positive revision from 201k to 270k. At the same time, unemployment rate fell from 3.9% to 3.7%, below the 3.8% predicted by experts and reaching the lowest level in 49 years. Average hourly earnings rose at the same 0.3% rate as in August (revised, 0.4% before the revision), in line with expectations. (Event A on the chart.)

US trade balance deficit rose from $50.0 billion in July to $53.2 billion in August, close to the consensus forecast of $53.4 billion. (Event A on the chart.)

Consumer credit rose by $20.1 billion in August from July. That is compared to an increase by $14.9 billion predicted by experts and the gain by $16.6 billion registered in the previous month. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.