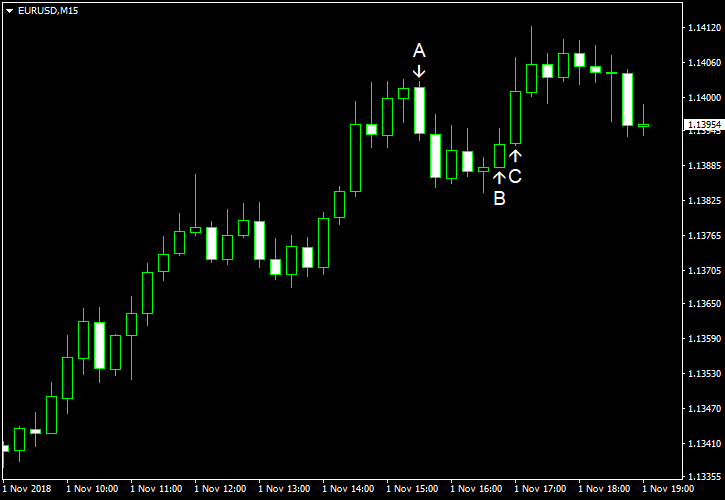

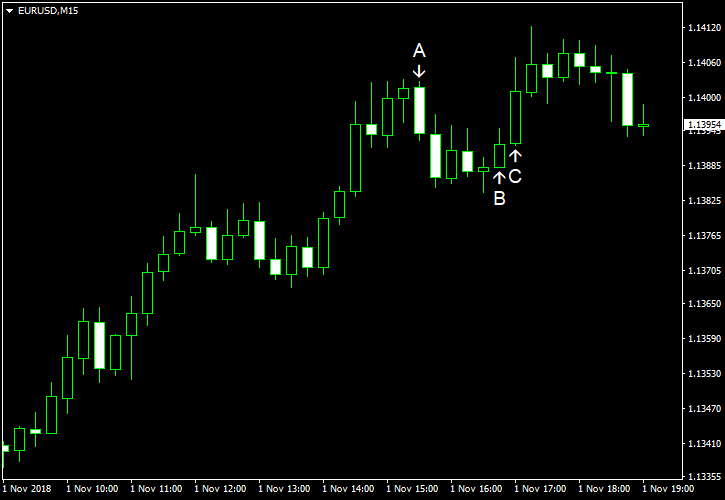

EUR/USD surged today following three consecutive sessions of losses. Market analysts speculated that it happened because the end-of-the-month dollar buying stopped. Hopes for fiscal stimulus in China was also among reasons named by analysts for the surge of the currency pair. Whatever the reason, traders were preferring riskier currencies over safer ones, and the dollar felt it.

Nonfarm productivity rose 2.2% in Q3 2018, matching forecasts exactly. The indicator was up 3.0% in Q2. (Event A on the chart.)

Initial jobless claims slipped a bit from 216k to 214k last week, in line with expectations. (Event A on the chart.)

Markit manufacturing PMI was at 55.7 in October, almost unchanged from September’s 55.6, according to the final estimate. The actual reading was not far from analysts’ forecasts and the preliminary estimate of 55.9. (Event B on the chart.)

ISM manufacturing PMI, on the other hand, dropped to 57.7% in October from 59.8% in September, far below the forecast value of 59.0%. (Event C on the chart.)

Construction spending showed no growth in September from the previous month, while experts had predicted an increase by 0.2%. The August increase got a big positive revision from 0.1% to 0.8%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.