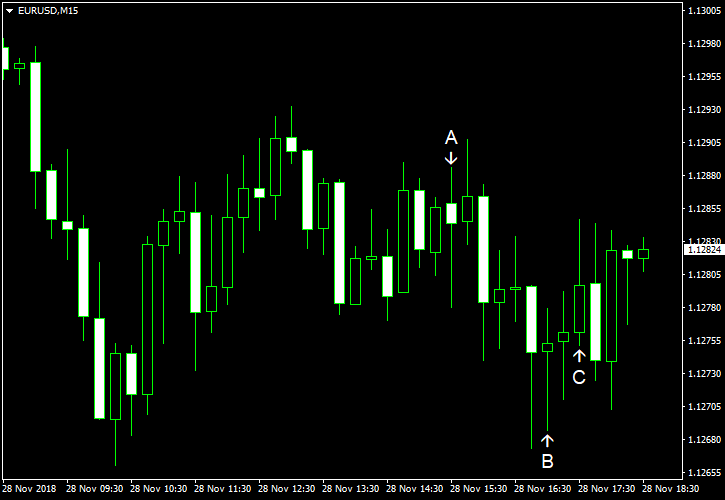

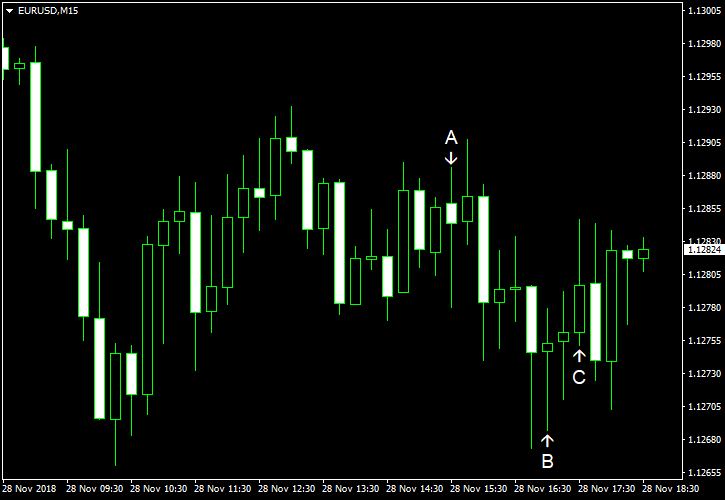

EUR/USD was stable today. While basically all macroeconomic reports released in the United States over the current trading session were disappointing, traders were not concerned with that, focusing their attention on the upcoming speech of Federal Reserve Chair Jerome Powell.

US GDP grew 3.5% in Q3 2018 according to the preliminary (second) estimate, unchanged from the advance (first) estimate. Market participants have hoped for a small upward revision to 3.6%. GDP rose 4.2% in Q2 2018. (Event A on the chart.)

New home sales were at the seasonally adjusted annual rate of 544k in October, down from the positively revised September rate of 597k (553k before the revision). The analysts’ average forecasts had promised a noticeably higher figure of 583k. (Event B on the chart.)

Richmond Fed manufacturing index slipped a bit from 15 in October to 14 in November, whereas experts had predicted it to inch up to 16. (Event B on the chart.)

Crude oil inventories swelled by 3.6 million barrels last week, much more than specialists had forecast (0.6 million barrels), and remained above the five-year average for this time of year. The stockpiles expanded by 4.9 million barrels the week before. Total motor gasoline inventories decreased by 0.8 million barrels last week but remained above the five-year average. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.