EUR/USD was mostly stable today. The currency pair attempted to rally after the minutes of the latest Federal Open Market Committee meeting. Yet the attempt failed, and the EUR/USD pair retreated almost immediately.

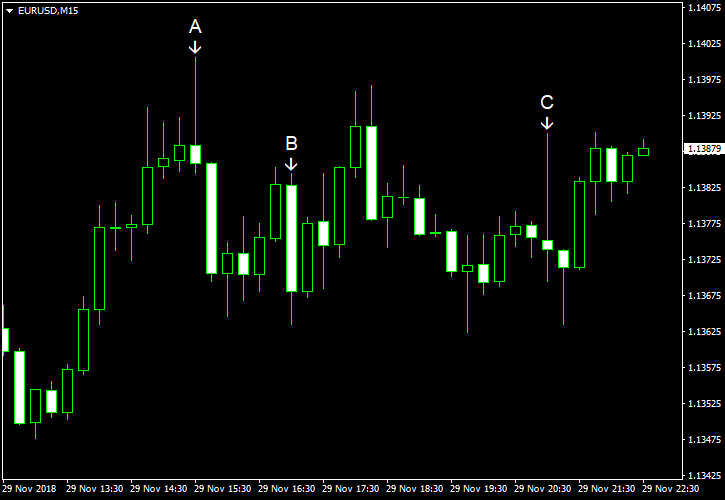

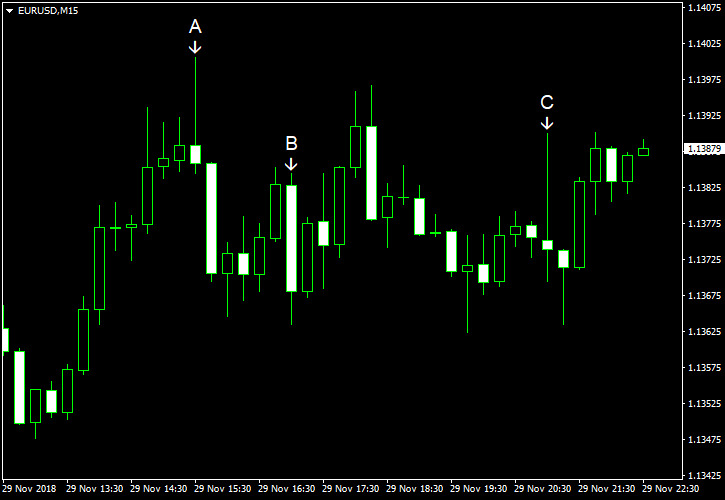

Personal income and spending rose in October more than was expected, 0.5% and 0.6% respectively. That is compared to the consensus forecast of 0.4% for both indicators and the 0.2% increase registered in September (unchanged from the initial estimate for income, revised down from 0.4% for spending). Core PCE inflation slowed to 0.1%, whereas economists had expected it to stay unchanged at 0.2%. (Event A on the chart.)

Initial jobless claims rose from 224k to 234k last week, while analysts had promised a decrease to 221k. (Event A on the chart.)

Pending home sales dropped 2.6% in October from September instead of rising 0.8% as experts had predicted. (Event B on the chart.) The September increase got a positive revision from 0.5% to 0.7%.

FOMC released minutes of its November meeting, which signaled that all FOMC members agreed may be lifted rather soon:

Consistent with their judgment that a gradual approach to policy normalization remained appropriate, almost all participants expressed the view that another increase in the target range for the federal funds rate was likely to be warranted fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations.

If you have any comments on the recent EUR/USD action, please reply using the form below.