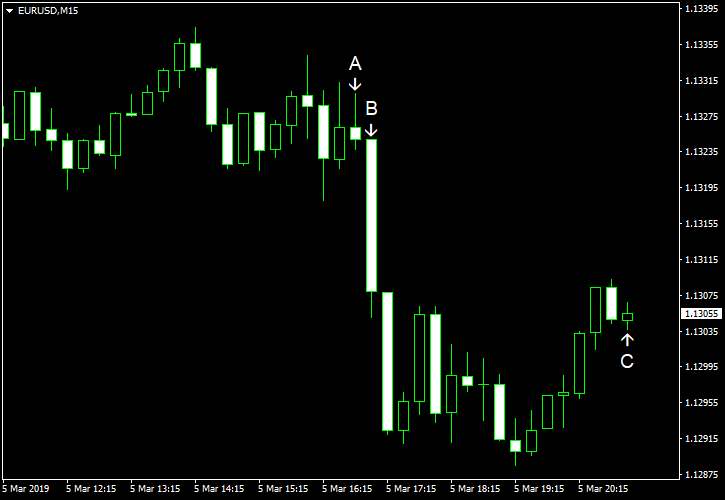

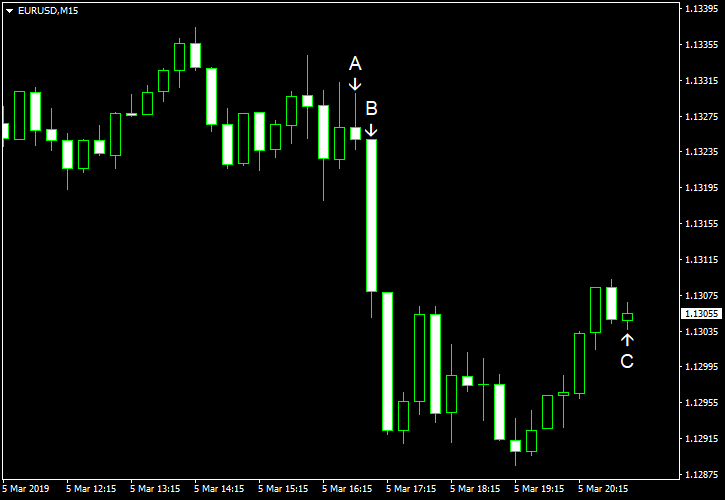

EUR/USD fell today. Positive US macroeconomic reports were pushing the currency pair down, though market analysts pointed at the rising US Treasury yields as another possible reason for the decline. Basically all of economic reports released in the United States today were good, and most of them beat expectations.

Markit services PMI climbed to 56.0 in February from 54.2 in January according to the final estimate. The actual figure was not far from analysts’ forecasts and the preliminary estimate of 56.2. (Event A on the chart.)

ISM services PMI also logged a significant gain, rising to 59.7% in February from 56.7% in January. Experts had predicted a modest increase to 57.4%. (Event B on the chart.)

New home sales were at the seasonally adjusted annual rate of 621k in December, up from the revised November figure of 599k (657k before the revision). Specialists had forecast a reading of 597k (Event B on the chart.)

Treasury budget turned from a deficit of $13.5 billion in December to a surplus of $8.7 billion in January. Still, it was a smaller surplus that a $17.3 billion excess predicted by analysts. (Event C on the chart.)

Yesterday, a report on construction spending was released, showing a drop by 0.6% in December from November. That is compared to the forecast increase of 0.2% and the 0.8% gain registered in the previous month. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.