EUR/USD tumbled today, touching the lows not seen since June 2017. The reason for the sharp dive was the extremely dovish monetary policy meeting of the European Central Bank. While the ECB kept its interest rates unchanged, it announced a new round of 2-year TLTROs in September this year and significantly downgraded its growth forecasts.

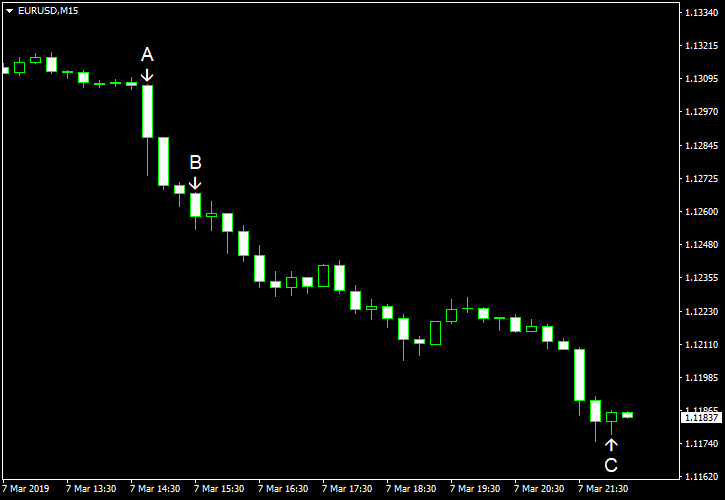

Nonfarm productivity rose 1.9% in Q4 2018 after increasing 2.3% in Q3. Analysts had predicted a smaller increase by 1.5%. (Event A on the chart.)

Initial jobless claims edged down a bit to 223k last week from the previous week’s revised level of 226k, whereas specialists had expected them to be basically unchanged. (Event B on the chart.)

Consumer credit rose by $17.0 billion in January, exceeding the average forecast of a $16.4 billion increase. The December increase got a negative revision from $16.6 billion to $15.4 billion. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.