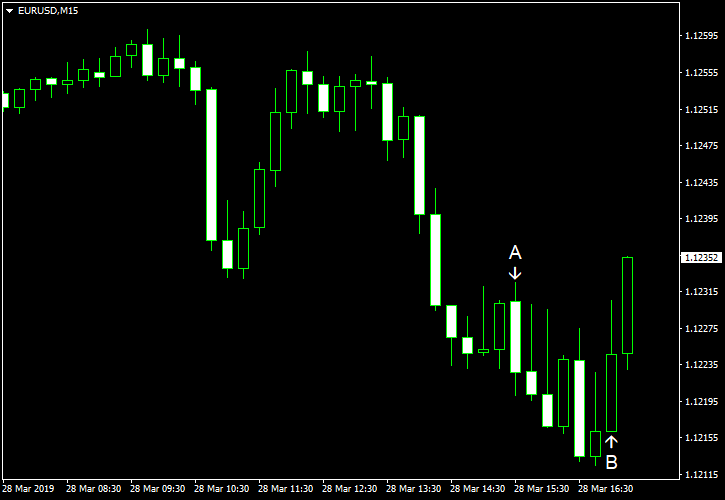

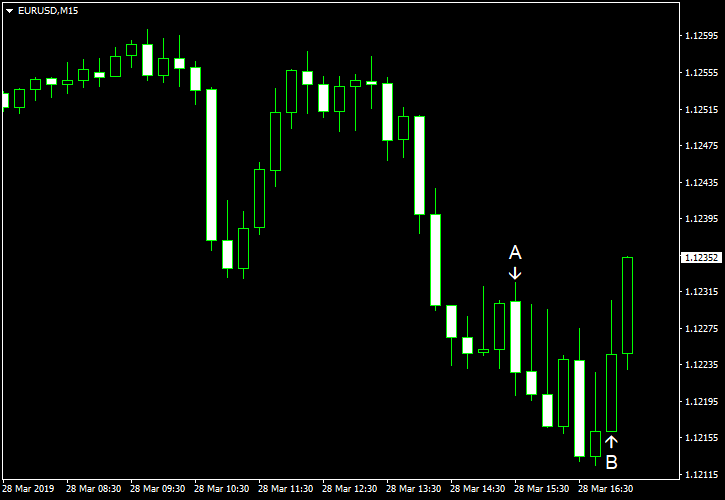

US economic growth was slower than previously estimated. But that did not prevent EUR/USD from extending its decline. Market analysts speculated that the reason for the currency pair’s poor performance was the outlook for the European Central Bank to keep interest rates low for an extended period of time. Additionally, the poor data increased demand for the greenback as a safe haven.

US GDP rose 2.2% in Q4 2018 according to the final estimate. That is below the consensus forecast of 2.4% and the preliminary estimate of 2.6%. The US economy grew 3.4% in Q3. (Event A on the chart.)

Initial jobless claims were at the seasonally adjusted level of 211k last week, down from the previous week’s revised level of 216k (221k before the revision). Market participants had expected an increase to 222k. (Event A on the chart.)

Pending home sales dropped 1.0% in February instead of rising 0.1% as experts had promised. Furthermore, the January increase of 4.6% got a negative revision to 4.3%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.