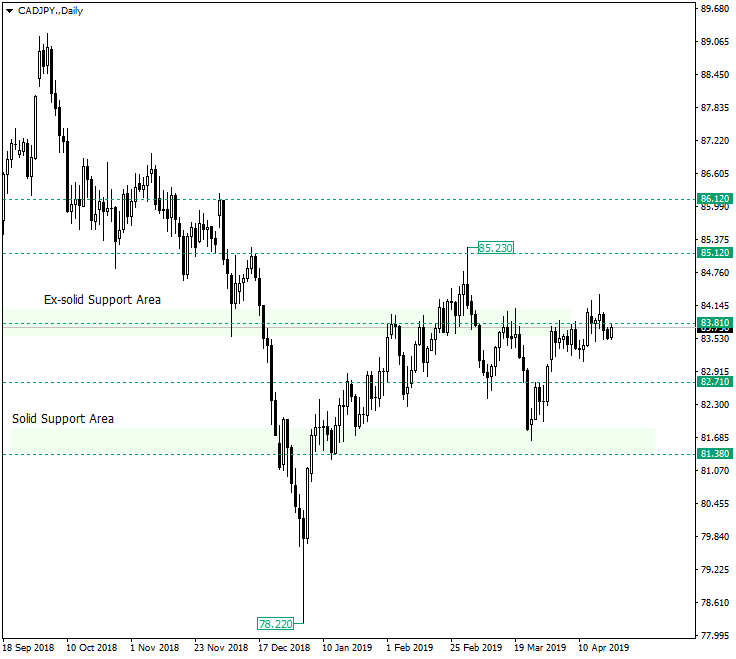

The Canadian dollar versus the Japanese yen is testing the important ex-solid support area of 83.81.

Long-term perspective

After bouncing from the currently solid support area of 81.38 on March 25, 2019, the price managed to surpass the 82.71 intermediary level and extend just under 83.81. There it entered a consolidation phase that lasted until almost the middle of April, on April 12, 2019, the price attempting to break the bearish barrier at 83.81 and reconquer the level. This initiative was not a success, nor it was a disaster. In other words both parties — the bulls and the bears — failed in their attempts: the bulls failed in driving prices higher and confirming 83.81 as support; the bears failed to make the price drop after the bulls showed that they do not have enough steam to reach their goal.

But here comes the interesting part: since the bears were not able tot do that much and since this 83.81 area is an important ex-support area, the message is that the direction towards price is most likely to point is north, targeting 85.12. The only issue would be if another attempt on the bulls side fails: if the price will insert itself above 83.81 and then cross back under it, then the confirmation of this area as a resistance is to be expected and 82.71 is in reach.

Short-term perspective

The 83.53 support seems to be holding well and this means that the price has what it takes to try conquering new resistances. As long as 83.53 is confirmed as a support or is falsely breached further advancements are possible, with the subsequent confirmation of 84.00, 84.35, and 84.49 as support levels.

An interesting reaction can take place with respect to the 84.99 level. If price manages to confirm it as a support, then the path to 84.35 is open. Another possibility is that the price would oscillate for a short-term period above it, only to get back to 83.52. This would mean that the advancement — at least on the short-term — is put to a wait, but not that it should be ruled out.

Levels to keep an eye on:

D1: 83.81 82.71 85.12

H1: 83.22 83.52 84.00 84.35 84.49

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.